Dow's $9B Alberta Project Delayed: Collateral Damage From Tariffs

Table of Contents

The Scope of Dow's Alberta Project and its Economic Significance

Dow Chemical's planned Alberta facility was poised to be a game-changer. The project promised to be a substantial petrochemical complex, producing a wide range of essential materials, including ethylene and polyethylene. Its projected output was substantial, aiming to create thousands of highly skilled jobs, both during construction and ongoing operation. Beyond direct employment, the project was expected to generate significant indirect economic activity, stimulating growth in related industries and boosting Alberta's overall GDP.

- Production Capacity: The plant's planned capacity was projected to significantly increase Canada's petrochemical production, reducing reliance on imports.

- Job Creation: Estimates suggested the project would create thousands of construction jobs and thousands more permanent positions in operation and related industries.

- Economic Diversification: This investment was viewed as crucial for diversifying Alberta's economy, moving beyond its heavy reliance on oil and gas.

- Investment Attraction: The project was seen as a catalyst, potentially attracting further investment in Alberta's petrochemical sector. Keywords: Petrochemical production, Alberta economy, job creation, economic diversification, investment, Canadian energy sector.

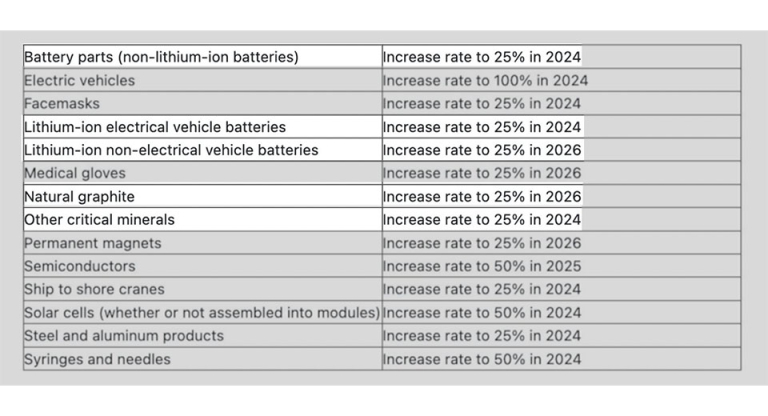

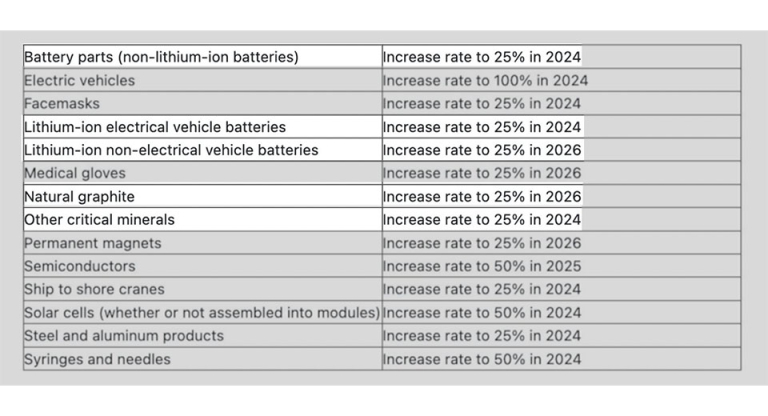

The Role of Tariffs in Delaying the Project

The primary culprit behind the project's delay is the imposition of various tariffs, primarily steel and aluminum tariffs, stemming from ongoing international trade disputes. These increased the project's overall cost significantly, rendering the initial financial projections unsustainable. The added expenses associated with imported materials impacted the project's profitability and ultimately prompted Dow Chemical to postpone construction.

- Increased Import Costs: Tariffs on steel and aluminum, essential materials for constructing such a large-scale facility, dramatically inflated the project budget.

- Project Cost Overruns: The unexpected increase in input costs led to substantial cost overruns, making the project financially unviable under the original timeline.

- Trade Disputes: The tariffs themselves were a direct result of ongoing trade disputes between nations, highlighting the fragility of global supply chains.

- Feasibility Challenges: The escalating costs challenged the project's feasibility, prompting Dow to reassess its investment strategy. Keywords: Trade tariffs, steel tariffs, aluminum tariffs, trade disputes, import costs, project cost overruns, global trade.

Impact of the Delay on Alberta's Economy and the Petrochemical Industry

The delay of Dow's project has significant consequences for Alberta's economy and the broader Canadian petrochemical landscape. The postponement translates to immediate and long-term economic losses. The immediate loss of thousands of projected construction jobs is a serious blow, further impacting related industries reliant on the project’s success. The delayed investment creates a ripple effect, reducing potential tax revenue for the provincial and federal governments and hindering Alberta's economic diversification efforts.

- Job Losses: The immediate and long-term job losses are substantial, affecting not only construction workers but also those employed in supporting industries.

- Investment Delays: The delay discourages further investment in Alberta's petrochemical sector, casting a shadow over future development plans.

- Reduced Tax Revenue: The delay means a substantial reduction in anticipated tax revenue, impacting government budgets and public services.

- Supply Chain Disruption: The delay contributes to supply chain disruptions in the Canadian petrochemical industry, impacting downstream industries. Keywords: Economic downturn, job losses, investment delays, tax revenue reduction, Canadian energy sector, petrochemical industry, supply chain disruption.

Potential Solutions and Future Outlook for Dow's Alberta Project

Addressing the challenges presented by tariffs requires a multi-pronged approach. Renegotiating trade deals to reduce or eliminate tariffs is crucial. Exploring alternative supply chains for construction materials, potentially sourcing from regions unaffected by the tariffs, could also mitigate cost increases. Government intervention, perhaps through financial incentives or tax breaks, could incentivize Dow to resume construction.

- Trade Negotiation: Active engagement in international trade negotiations to secure favorable trade agreements is essential to remove these barriers.

- Government Support: Government incentives and support could help offset the increased costs and make the project more financially viable.

- Alternative Supply Chains: Diversifying the supply chain by sourcing materials from different regions could reduce reliance on tariff-affected imports.

- Project Completion: A renewed commitment from all stakeholders—Dow, the Alberta government, and the federal government—is crucial to ensure eventual project completion. Keywords: Trade negotiation, government support, alternative supply chains, project completion, economic recovery.

Conclusion: The Future of Dow's Alberta Project and the Impact of Tariffs

The delay of Dow's $9 billion Alberta project underscores the profound impact of tariffs and trade disputes on large-scale investments and economic development. The potential economic losses—in terms of job creation, investment, and tax revenue—are substantial, emphasizing the need for proactive strategies to address trade barriers. The future of this project, and similar large-scale endeavors, hinges on resolving trade disputes and creating a stable and predictable investment climate. Stay informed about the developments surrounding Dow's Alberta project and the ongoing impact of tariffs on Canadian business. Learn more about trade policy and its effects on major infrastructure projects. Keywords: trade policy, economic impacts, Alberta investments.

Featured Posts

-

Hamlin Secures First Martinsville Victory Ending A Long Wait

Apr 28, 2025

Hamlin Secures First Martinsville Victory Ending A Long Wait

Apr 28, 2025 -

Richard Jeffersons Espn Future Uncertainty Surrounds Nba Finals Coverage

Apr 28, 2025

Richard Jeffersons Espn Future Uncertainty Surrounds Nba Finals Coverage

Apr 28, 2025 -

Evaluating Pitchers Name Will He Crack The Mets Starting Rotation

Apr 28, 2025

Evaluating Pitchers Name Will He Crack The Mets Starting Rotation

Apr 28, 2025 -

Mets Fall To Twins 3 6 Series Tied

Apr 28, 2025

Mets Fall To Twins 3 6 Series Tied

Apr 28, 2025 -

Understanding Chinas Partial Tariff Rollback On Us Goods

Apr 28, 2025

Understanding Chinas Partial Tariff Rollback On Us Goods

Apr 28, 2025

Latest Posts

-

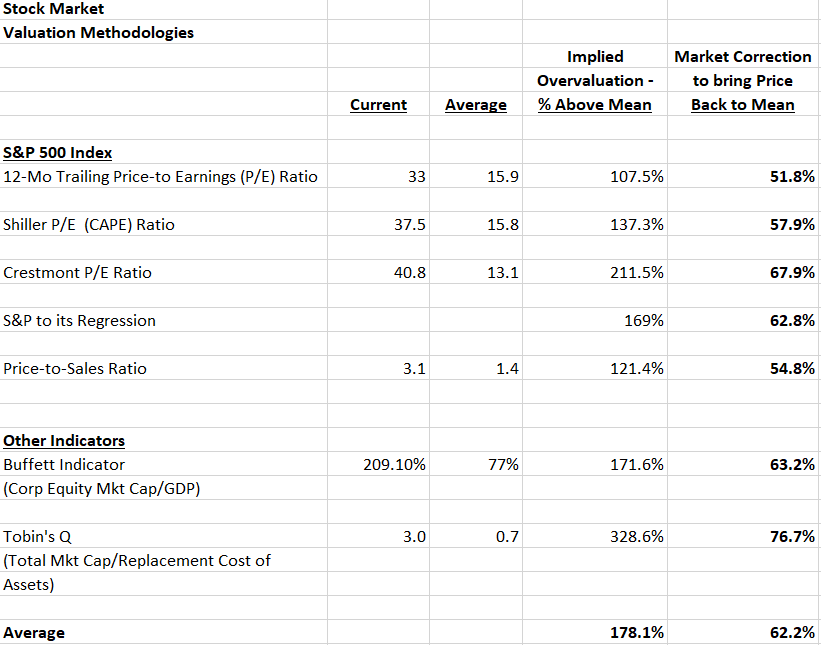

Stock Market Valuation Concerns A Rebuttal From Bof A

May 10, 2025

Stock Market Valuation Concerns A Rebuttal From Bof A

May 10, 2025 -

Are High Stock Market Valuations A Concern Bof As Analysis

May 10, 2025

Are High Stock Market Valuations A Concern Bof As Analysis

May 10, 2025 -

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 10, 2025

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 10, 2025 -

Invest Smart A Guide To The Countrys Rising Business Hot Spots

May 10, 2025

Invest Smart A Guide To The Countrys Rising Business Hot Spots

May 10, 2025 -

The Shifting Sands Of The Chinese Automotive Market Impact On Bmw Porsche And Others

May 10, 2025

The Shifting Sands Of The Chinese Automotive Market Impact On Bmw Porsche And Others

May 10, 2025