FirstUp: IMF To Review $1.3 Billion Pakistan Loan Amidst Rising Tensions

Table of Contents

The $1.3 Billion Loan and its Conditions

The $1.3 billion loan represents a lifeline for Pakistan, struggling under the weight of crippling debt and soaring inflation. This tranche is part of a larger bailout package agreed upon under a strict Extended Fund Facility (EFF) program. The IMF, in exchange for its financial assistance, has imposed a series of stringent conditions aimed at stabilizing Pakistan's economy. These conditions necessitate significant structural reforms across various sectors.

- Energy Sector Reforms: Addressing long-standing inefficiencies and losses in the energy sector, including tackling circular debt and improving electricity generation and distribution.

- Tax Reforms: Improving tax collection efficiency, broadening the tax base, and reducing tax evasion to boost government revenue.

- Fiscal Consolidation: Implementing measures to reduce the fiscal deficit through expenditure cuts and revenue enhancement.

- Exchange Rate Adjustments: Allowing the Pakistani Rupee to find its market value, a move that could lead to short-term pain but is crucial for long-term economic stability.

Meeting these conditions presents formidable challenges for Pakistan. Implementing unpopular reforms can spark social unrest, while the necessary fiscal adjustments could further impact the already strained living standards of many Pakistanis. The successful navigation of these reforms is crucial for a positive outcome in the IMF Pakistan loan review.

Rising Tensions and their Influence on the Review

Pakistan's political landscape is currently marked by significant instability and growing security concerns. These tensions cast a long shadow over the IMF Pakistan loan review, raising questions about the country's capacity to implement the required reforms.

- Political Instability: Frequent changes in government and policy can hinder the implementation of long-term economic strategies, making it difficult to convince the IMF of Pakistan's commitment to reform.

- Security Concerns: Ongoing security challenges can deter foreign investment and further weaken investor confidence, undermining economic growth.

- Delayed Disbursement: The IMF might hesitate to release funds if political and security conditions deteriorate, potentially leading to a further economic downturn.

The IMF’s assessment will be greatly influenced by the perception of stability and the government’s ability to effectively address these challenges. A failure to demonstrate progress in these areas could jeopardize the loan's disbursement.

Pakistan's Economic Outlook and Potential Scenarios

Pakistan's current economic situation is precarious, characterized by high inflation, a substantial debt burden, and sluggish growth prospects. The outcome of the IMF Pakistan loan review will significantly shape the country's economic trajectory.

- Optimistic Scenario: A successful review leading to the full disbursement of the $1.3 billion loan could inject much-needed liquidity into the economy, stabilizing the Rupee, and potentially fostering economic growth.

- Pessimistic Scenario:** A failed review could trigger a severe economic crisis, potentially resulting in default on its debts and further exacerbating the existing challenges, leading to further devaluation and inflation.

- Neutral Scenario:** A partial disbursement with stricter conditions imposed by the IMF could lead to a slow and difficult recovery, characterized by continued austerity measures and limited economic growth.

International Implications of the IMF's Decision

The IMF's decision on Pakistan's loan request carries significant international implications. The outcome will impact regional stability and investor sentiment towards emerging markets.

- Regional Stability: A significant economic crisis in Pakistan could have destabilizing effects on neighboring countries, potentially triggering a regional economic downturn.

- Investor Sentiment: The IMF's decision will be closely watched by international investors, influencing their confidence in investing in other emerging markets.

- Role of other International Financial Institutions: The World Bank and other international financial institutions will likely monitor the situation and adjust their engagement with Pakistan based on the IMF’s decision.

Conclusion: The Future of the IMF Pakistan Loan Review

The IMF Pakistan loan review is a pivotal moment for Pakistan. The outcome will profoundly shape the country's economic stability and political landscape. The ongoing tensions within the country significantly influence the likelihood of loan disbursement. The potential scenarios range from a positive boost to the economy to a full-blown economic crisis. To stay informed about further developments in the IMF Pakistan loan situation and the IMF's decision on Pakistan's loan, follow reputable news sources and the official statements of the IMF and the Pakistani government. Understanding the evolving Pakistan IMF loan review is crucial for comprehending the future of Pakistan's economic and political trajectory.

Featured Posts

-

Trumps Greenland Gambit A Deeper Look At Increased Danish Influence

May 09, 2025

Trumps Greenland Gambit A Deeper Look At Increased Danish Influence

May 09, 2025 -

The Wolves Rejection That Fueled A European Football Legend

May 09, 2025

The Wolves Rejection That Fueled A European Football Legend

May 09, 2025 -

Car Dealerships Double Down On Opposition To Electric Vehicle Regulations

May 09, 2025

Car Dealerships Double Down On Opposition To Electric Vehicle Regulations

May 09, 2025 -

Accessible Stock Trading The Impact Of The Jazz Cash And K Trade Partnership

May 09, 2025

Accessible Stock Trading The Impact Of The Jazz Cash And K Trade Partnership

May 09, 2025 -

Stock Market Prediction Will These 2 Stocks Outpace Palantir 3 Year Outlook

May 09, 2025

Stock Market Prediction Will These 2 Stocks Outpace Palantir 3 Year Outlook

May 09, 2025

Latest Posts

-

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025 -

Indian Insurers Seek Regulatory Easing For Bond Forward Trading

May 10, 2025

Indian Insurers Seek Regulatory Easing For Bond Forward Trading

May 10, 2025 -

Chinas Steel Production Cuts And The Future Of Iron Ore Prices

May 10, 2025

Chinas Steel Production Cuts And The Future Of Iron Ore Prices

May 10, 2025 -

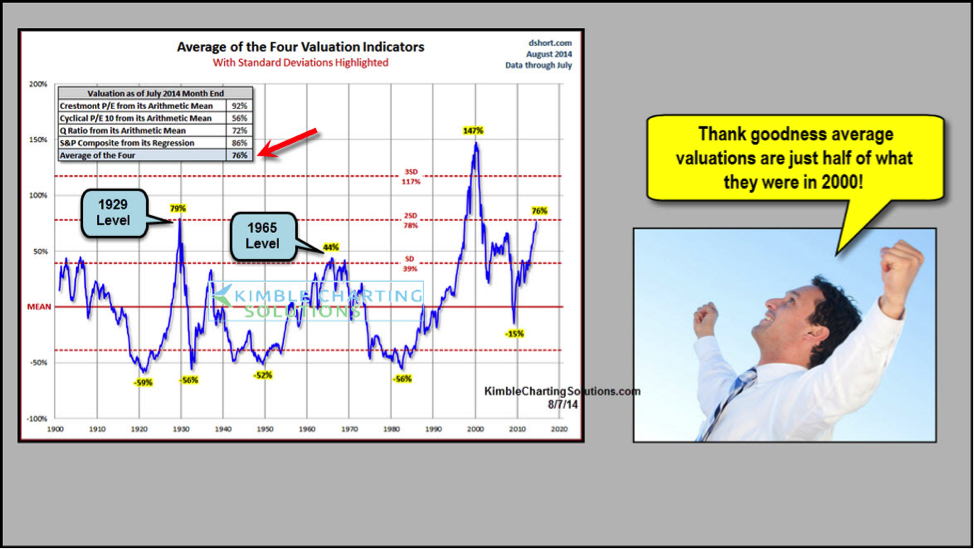

Stock Market Valuations Why Bof A Believes Investors Shouldnt Worry

May 10, 2025

Stock Market Valuations Why Bof A Believes Investors Shouldnt Worry

May 10, 2025 -

Bof As Reassurance Addressing Concerns About Stretched Stock Market Valuations

May 10, 2025

Bof As Reassurance Addressing Concerns About Stretched Stock Market Valuations

May 10, 2025