Potential $3 Billion Crypto SPAC: Cantor, Tether, And SoftBank Negotiations

Table of Contents

The Players Involved: Cantor, Tether, and SoftBank

This potential $3 billion crypto SPAC brings together three powerful entities, each with unique expertise and influence within their respective sectors. Understanding their roles is crucial to comprehending the potential implications of this deal.

Cantor Fitzgerald's Role

Cantor Fitzgerald, a prominent player in global financial markets, is rumored to be playing a significant role in this potential crypto SPAC, possibly acting as a lead advisor or underwriter. Their extensive experience in complex financial transactions, including previous successful SPAC deals, makes them a strong contender.

- Past Successes: Cantor has a proven track record in facilitating successful SPAC mergers, bringing significant expertise in navigating the complexities of these deals.

- Established Reputation: Their established reputation in the financial world adds credibility and trust to this potentially high-risk venture in the crypto space.

- Industry Benefits: Cantor's involvement could provide much-needed legitimacy and structure to the cryptocurrency industry, attracting more traditional investors.

Tether's Significance

Tether, a leading stablecoin pegged to the US dollar, is a crucial element in this potential $3 billion crypto SPAC. Its vast market capitalization and widespread use within the crypto ecosystem make it a key player. However, concerns surrounding Tether's regulatory status and market volatility must be addressed.

- Market Dominance: Tether's substantial market capitalization significantly influences the overall cryptocurrency market. Its involvement brings both potential and risk.

- Ecosystem Integration: Tether is deeply integrated into the crypto ecosystem, facilitating transactions and providing stability in a volatile market. Its success is intrinsically linked to the broader crypto market.

- Risks and Rewards: While its integration offers stability, the regulatory uncertainty around Tether presents risks. The success of the SPAC hinges on navigating these regulatory hurdles.

SoftBank's Investment Strategy

SoftBank, a prominent technology investor known for its significant investments in various sectors including fintech, is a potential major investor in this crypto SPAC. Their participation signals a potentially significant influx of capital into the cryptocurrency sector.

- Tech and Fintech Expertise: SoftBank's extensive investment portfolio in technology and financial technology companies demonstrates their strategic interest in disruptive technologies.

- Risk Tolerance: SoftBank's history of high-risk, high-reward investments suggests a willingness to bet big on the future of cryptocurrency.

- Potential Returns: The potential returns on investment in a successful crypto SPAC are substantial, aligning with SoftBank's aggressive investment strategy.

The Potential Benefits of a $3 Billion Crypto SPAC

A successful $3 billion crypto SPAC could bring numerous benefits to the cryptocurrency industry and its investors.

Increased Market Capitalization

The infusion of capital from a SPAC could dramatically increase the market capitalization of the target crypto company. This would significantly boost investor confidence and attract further investment.

- Illustrative Examples: Analyzing previous successful SPAC deals in the tech sector provides a benchmark for the potential impact on market cap.

- Investor Confidence: A successful merger can significantly improve investor confidence in the crypto space, drawing in a new wave of institutional investment.

Enhanced Regulatory Compliance

This deal could potentially push for greater regulatory scrutiny and compliance within the cryptocurrency industry. This, in turn, could lead to increased investor trust and mainstream adoption.

- Improved Regulatory Landscape: The deal might encourage dialogue and collaboration between crypto companies and regulators, leading to a clearer regulatory framework.

- Increased Trust: Enhanced compliance will make the crypto market more appealing to institutional investors who require robust regulatory oversight.

Access to Capital for Crypto Innovation

The significant capital injection from a $3 billion crypto SPAC could provide much-needed funding for innovation and development in the cryptocurrency sector.

- New Technologies: The capital could be used to fund research and development in various areas such as blockchain technology, decentralized finance (DeFi), and non-fungible tokens (NFTs).

- New Applications: The influx of capital could accelerate the development and adoption of innovative crypto applications across various industries.

Potential Challenges and Risks

Despite the potential benefits, this $3 billion crypto SPAC faces several challenges and risks.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies remains uncertain globally. This uncertainty poses a significant threat to the deal's success.

- Regulatory Hurdles: Various regulatory bodies worldwide are still developing frameworks for cryptocurrencies, leading to potential delays or even the failure of the deal.

- Jurisdictional Differences: The differing regulatory environments in various jurisdictions present additional complexities in structuring and executing the deal.

Market Volatility

The cryptocurrency market is notoriously volatile. This inherent instability presents a major risk to the success of the $3 billion crypto SPAC.

- Market Fluctuations: Sudden market downturns could significantly impact the valuation of the target crypto company and the overall success of the SPAC.

- Risk Mitigation: Implementing effective risk management strategies is crucial to mitigate the impact of market volatility.

Valuation Concerns

Accurately valuing crypto assets remains a challenge. This difficulty increases the risk of overvaluation in the context of a SPAC merger.

- Valuation Challenges: The lack of standardized valuation methods for crypto assets makes determining a fair market value difficult.

- Overvaluation Risk: The pressure to secure a deal might lead to inflated valuations, potentially leading to financial losses for investors.

Conclusion: Analyzing the Potential $3 Billion Crypto SPAC Deal

This potential $3 billion crypto SPAC deal involving Cantor Fitzgerald, Tether, and SoftBank presents a fascinating case study in the evolving landscape of cryptocurrency and finance. While it offers significant potential benefits – increased market capitalization, enhanced regulatory compliance, and access to capital for crypto innovation – it's crucial to acknowledge the inherent risks, including regulatory uncertainty, market volatility, and valuation concerns. The success of this venture will significantly impact the future of the crypto market. Stay tuned for updates on this groundbreaking crypto SPAC and follow our coverage for further analysis of this potential $3 billion crypto SPAC deal.

Featured Posts

-

Newsom Calls On Oil Industry To Address Soaring California Gas Prices

Apr 24, 2025

Newsom Calls On Oil Industry To Address Soaring California Gas Prices

Apr 24, 2025 -

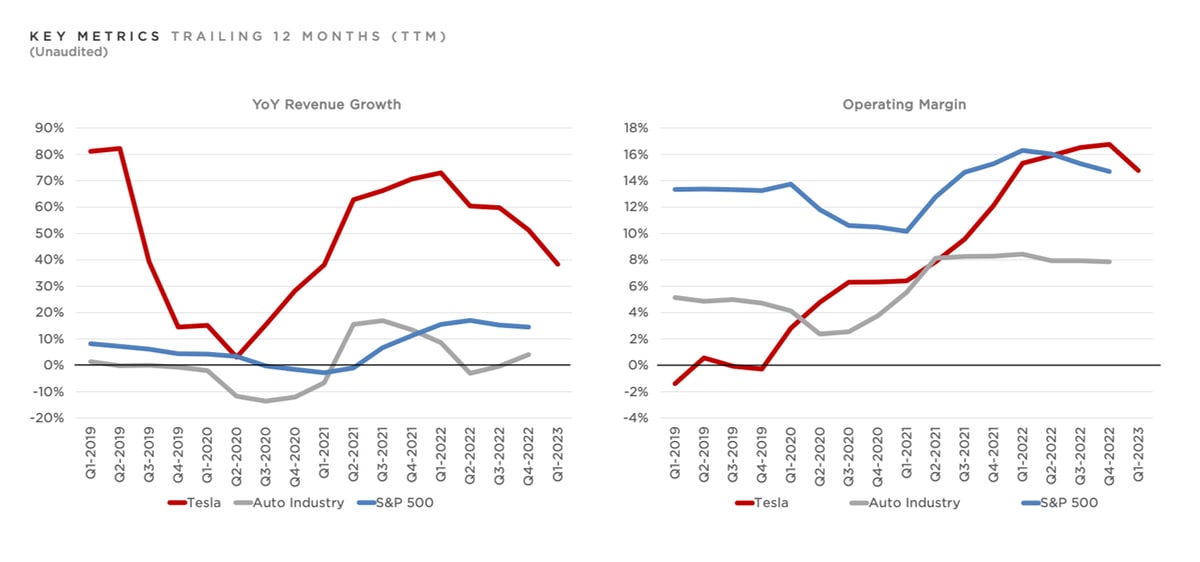

Tesla Earnings Plunge 71 In Q1 Analysis Of Political Factors And Financial Results

Apr 24, 2025

Tesla Earnings Plunge 71 In Q1 Analysis Of Political Factors And Financial Results

Apr 24, 2025 -

Nba 3 Point Contest Herro Beats Hield In Thrilling Finish

Apr 24, 2025

Nba 3 Point Contest Herro Beats Hield In Thrilling Finish

Apr 24, 2025 -

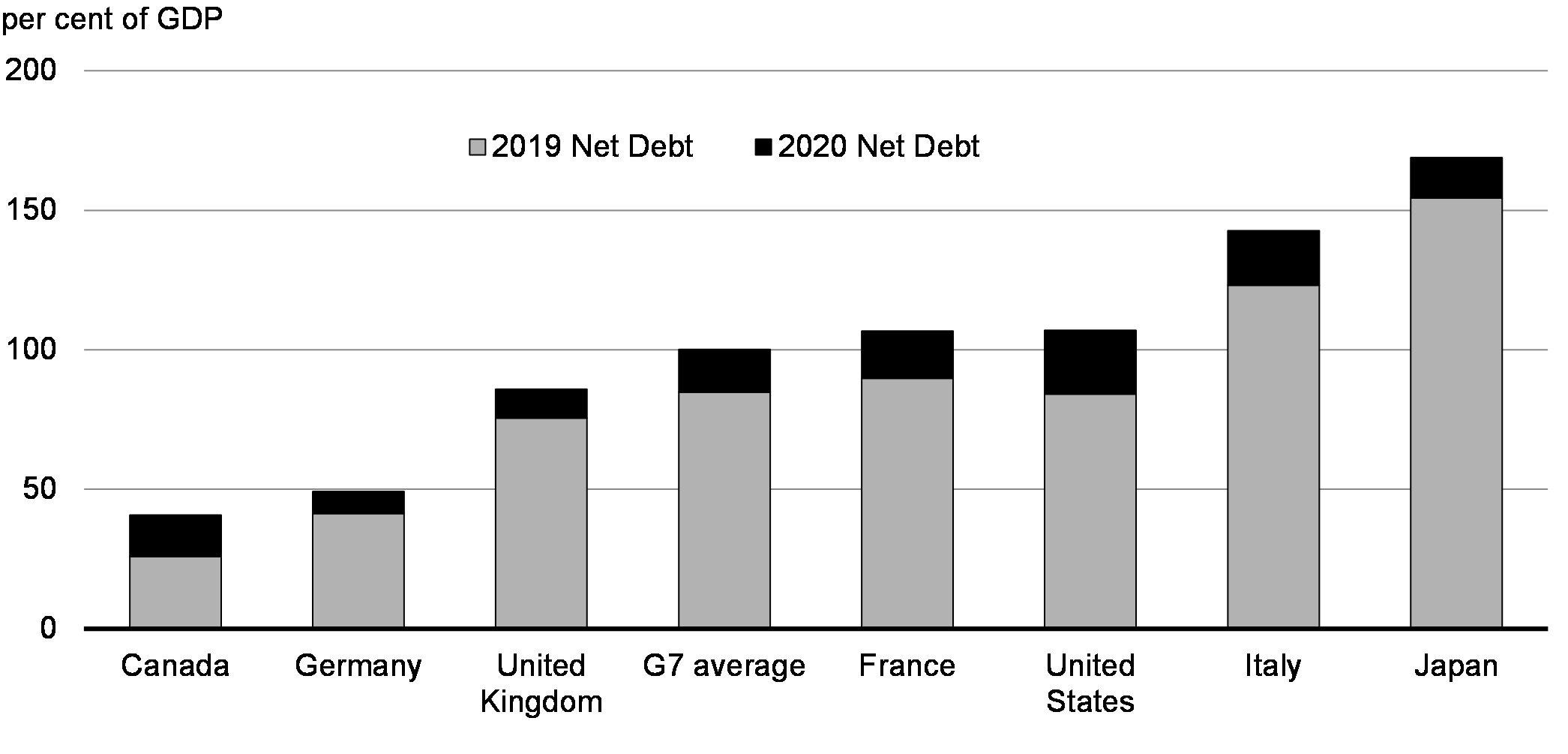

Is Canadas Fiscal Policy Sustainable Examining Liberal Economic Policies

Apr 24, 2025

Is Canadas Fiscal Policy Sustainable Examining Liberal Economic Policies

Apr 24, 2025 -

Emerging Market Stock Surge A Winning Strategy Amidst Us Uncertainty

Apr 24, 2025

Emerging Market Stock Surge A Winning Strategy Amidst Us Uncertainty

Apr 24, 2025