Today's Losses: Frankfurt DAX Market Close

Table of Contents

Key Factors Contributing to Today's DAX Losses

Several economic and geopolitical factors played a significant role in today's DAX decline. Market volatility was high, reflecting a confluence of influences impacting investor sentiment and driving down the DAX index.

-

Impact of rising inflation and potential interest rate hikes by the European Central Bank (ECB): The persistent rise in inflation across the Eurozone continues to pressure the ECB to implement further interest rate hikes. This prospect dampens investor confidence, as higher interest rates increase borrowing costs for businesses and potentially slow economic growth. The expectation of tighter monetary policy weighs heavily on market sentiment, contributing to today's losses.

-

Influence of weakening Euro against the US dollar: The Euro's weakening against the US dollar further exacerbated the negative impact on the DAX. This makes European exports more expensive and reduces the competitiveness of German companies in the global market. A weaker Euro also impacts the profitability of German companies with significant international operations.

-

Analysis of the effect of ongoing geopolitical tensions (e.g., the war in Ukraine): The ongoing war in Ukraine continues to cast a long shadow over the global economy and specifically impacts the German DAX. Energy prices remain elevated due to disruptions in supply chains, adding pressure on businesses and consumers alike. Uncertainty surrounding the conflict's duration and potential escalation contributes to market instability.

-

Discussion of global market trends and their correlation with the DAX's performance: Today's DAX performance is also correlated with broader global market trends. A negative sentiment in other major global markets, such as the US and Asian markets, often translates into a negative impact on the DAX, reinforcing the interconnectedness of the global financial system.

DAX Index Performance Breakdown

Let's examine the precise numerical breakdown of the DAX's performance for today.

-

The DAX's opening price, closing price, and percentage change: The DAX opened at [Insert Opening Price], closed at [Insert Closing Price], representing a [Insert Percentage Change]% decline.

-

High and low points of the day: The DAX reached a high of [Insert High Point] and a low of [Insert Low Point] during today's trading session.

-

Total volume traded: The total volume traded in the DAX today was [Insert Volume Traded], indicating [Insert Interpretation, e.g., higher than average trading activity, suggesting increased volatility].

-

Analysis of the DAX chart, highlighting significant price movements: [Insert analysis of the DAX chart, highlighting significant price movements throughout the day. Include a relevant chart or graph visualizing the DAX's performance].

Biggest Losers in Today's Frankfurt DAX Market

Several sectors and individual companies experienced significant losses in today's trading.

-

List of top 5-10 underperforming companies within the DAX, along with their percentage decline: [Insert a table listing the top underperforming companies, their sector, and their percentage decline].

-

Analysis of the reasons behind the underperformance of these specific companies (e.g., company-specific news, sector-wide trends): [Provide a detailed analysis for each of the top underperforming companies, explaining the reasons behind their poor performance. Consider factors such as company-specific news, earnings reports, and sector-wide trends.]

-

Discussion of any potential implications for these companies' future performance: [Discuss the potential short-term and long-term implications of these losses on the affected companies, considering factors such as investor confidence, future growth prospects, and potential strategic responses.]

Sector-Specific Analysis

A closer look at sector-specific performance reveals further insights into today's DAX losses.

- DAX sectors, sector performance: [Provide a breakdown of the performance of key sectors within the DAX, such as the financial sector, automotive sector, and technology sector. Highlight any significant differences in performance across sectors.] For example: The automotive sector experienced a steeper decline than the technology sector, possibly reflecting concerns about supply chain disruptions and slowing consumer demand.

Conclusion

This article has provided an in-depth analysis of today's losses in the Frankfurt DAX market, exploring the contributing factors, index performance, and the biggest losers. We examined the influence of inflation, interest rates, geopolitical risks, and global market trends on the DAX's decline. Understanding these interconnected factors is critical for navigating the complexities of the German stock market.

Call to Action: Stay informed about daily fluctuations in the Frankfurt DAX market by regularly checking back for our daily market close reports. Understanding the dynamics of the Frankfurt DAX market is crucial for successful investing. Keep abreast of the latest developments to make informed decisions in the volatile DAX index landscape. For more in-depth analysis and insights, subscribe to our newsletter for daily updates on the German stock market.

Featured Posts

-

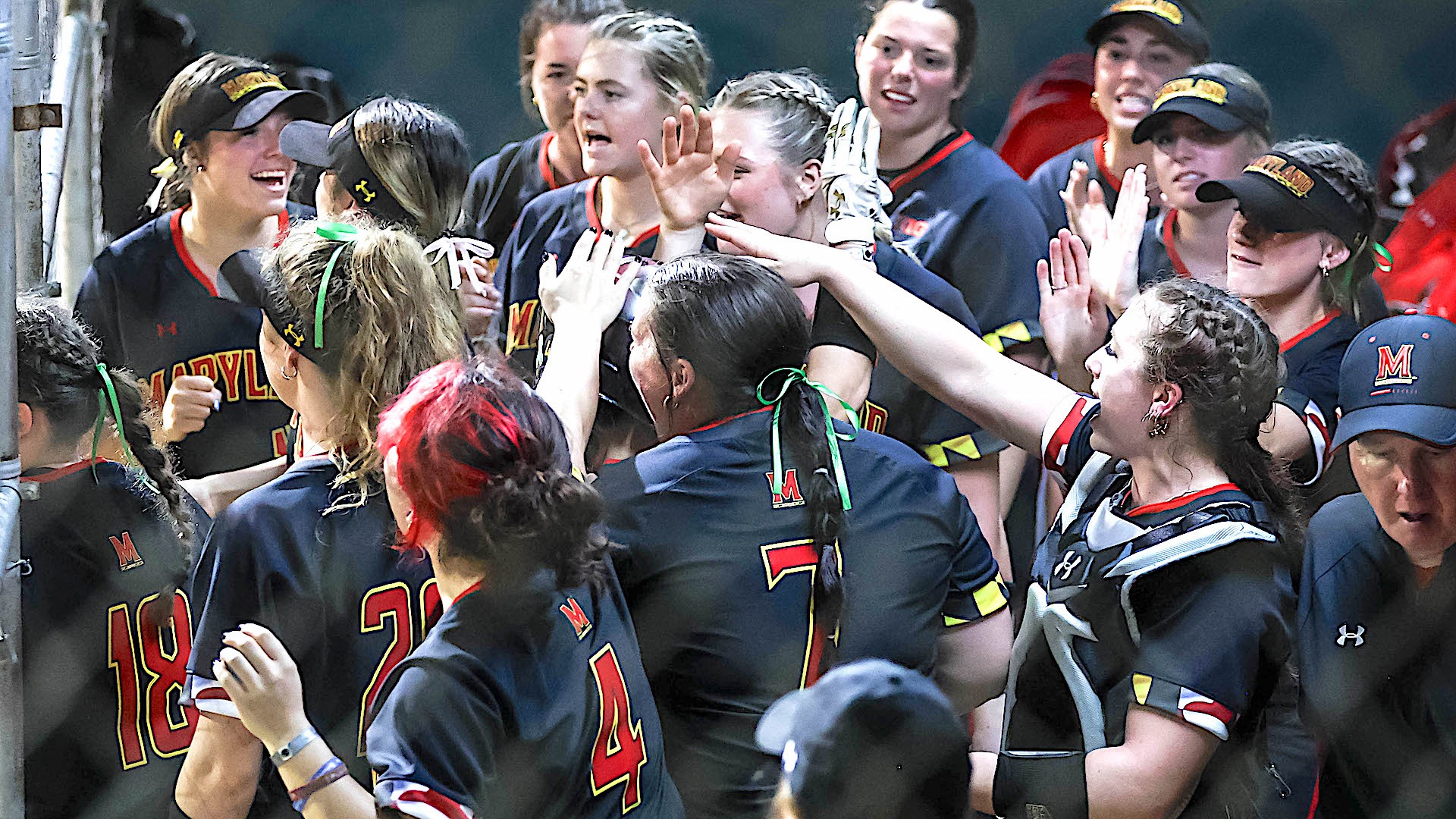

Aubrey Wurst Leads Maryland Softball To Victory Over Delaware

May 24, 2025

Aubrey Wurst Leads Maryland Softball To Victory Over Delaware

May 24, 2025 -

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazione Ue

May 24, 2025

Guerra Dei Dazi Impatto Sulle Borse Europee E Reazione Ue

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value

May 24, 2025 -

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025 -

Uomini Piu Ricchi Del Mondo 2025 Musk Zuckerberg E Bezos Nella Classifica Forbes

May 24, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Zuckerberg E Bezos Nella Classifica Forbes

May 24, 2025

Latest Posts

-

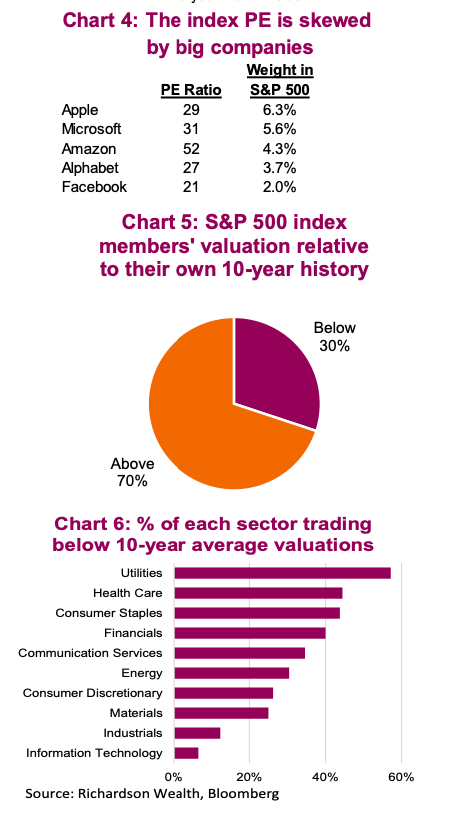

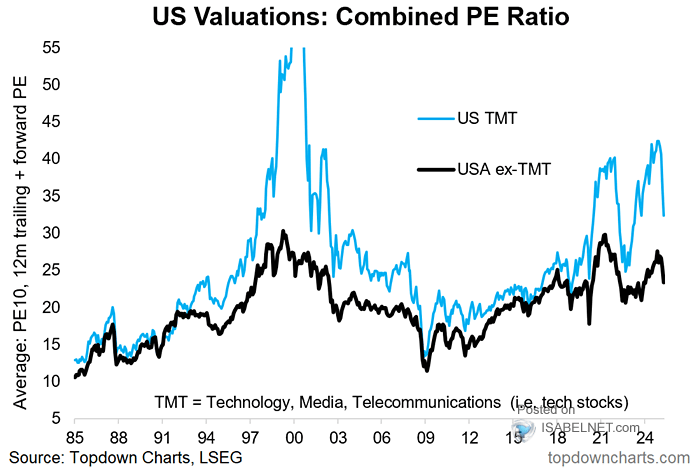

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025 -

Bof A On Stock Market Valuations A Reasoned Perspective For Investors

May 24, 2025

Bof A On Stock Market Valuations A Reasoned Perspective For Investors

May 24, 2025 -

Thames Water Executive Bonuses A Look At The Figures And Public Reaction

May 24, 2025

Thames Water Executive Bonuses A Look At The Figures And Public Reaction

May 24, 2025 -

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025 -

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025