Will Berkshire Hathaway Sell Apple Stock After Buffett's Departure?

Table of Contents

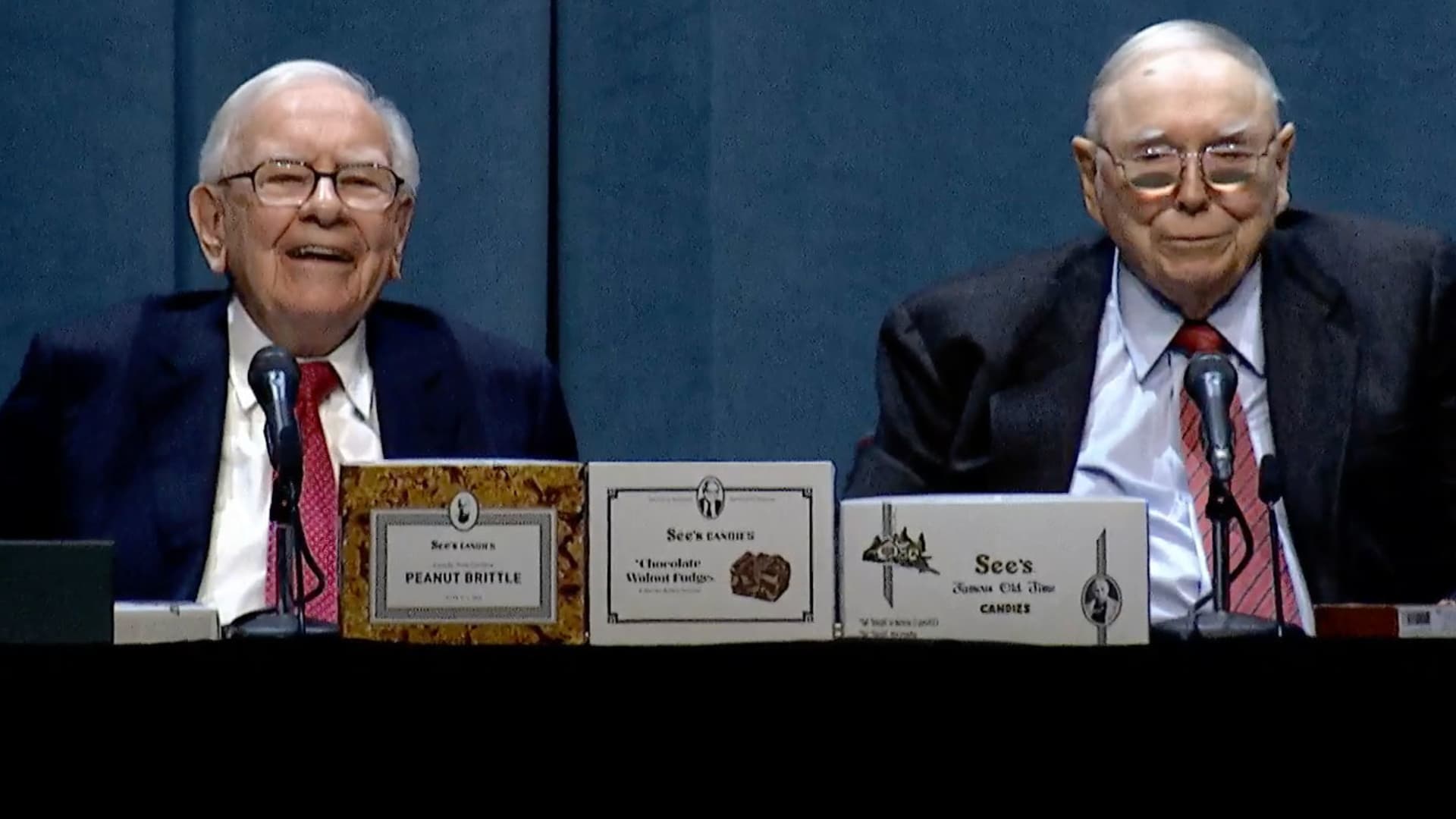

Buffett's Legacy and Berkshire Hathaway's Apple Investment

Warren Buffett's long-term investment philosophy, focused on identifying fundamentally strong companies with durable competitive advantages, aligns perfectly with Apple's business model. Apple's consistent profitability, strong brand loyalty, and innovative product pipeline have made it a cornerstone of Berkshire Hathaway's portfolio. Berkshire Hathaway's Apple holdings represent a substantial portion of its overall investment portfolio, making any changes to this stake highly significant.

- Historical Performance: Berkshire Hathaway's investment in Apple has yielded substantial returns, significantly contributing to the company's overall growth and shareholder value. The Buffett Apple stock investment serves as a prime example of his successful long-term investment strategy.

- Reasons for Initial Investment: Buffett's initial investment in Apple was driven by his recognition of its strong brand, loyal customer base, and recurring revenue streams from services. He saw a company with a lasting competitive advantage in the tech sector.

- Apple's Consistent Growth: Apple's consistent growth and profitability, fueled by its diverse product ecosystem and expanding services revenue, underpin the success of Berkshire Hathaway's Apple investment. The value of Buffett Apple stock is inextricably linked to Apple's performance.

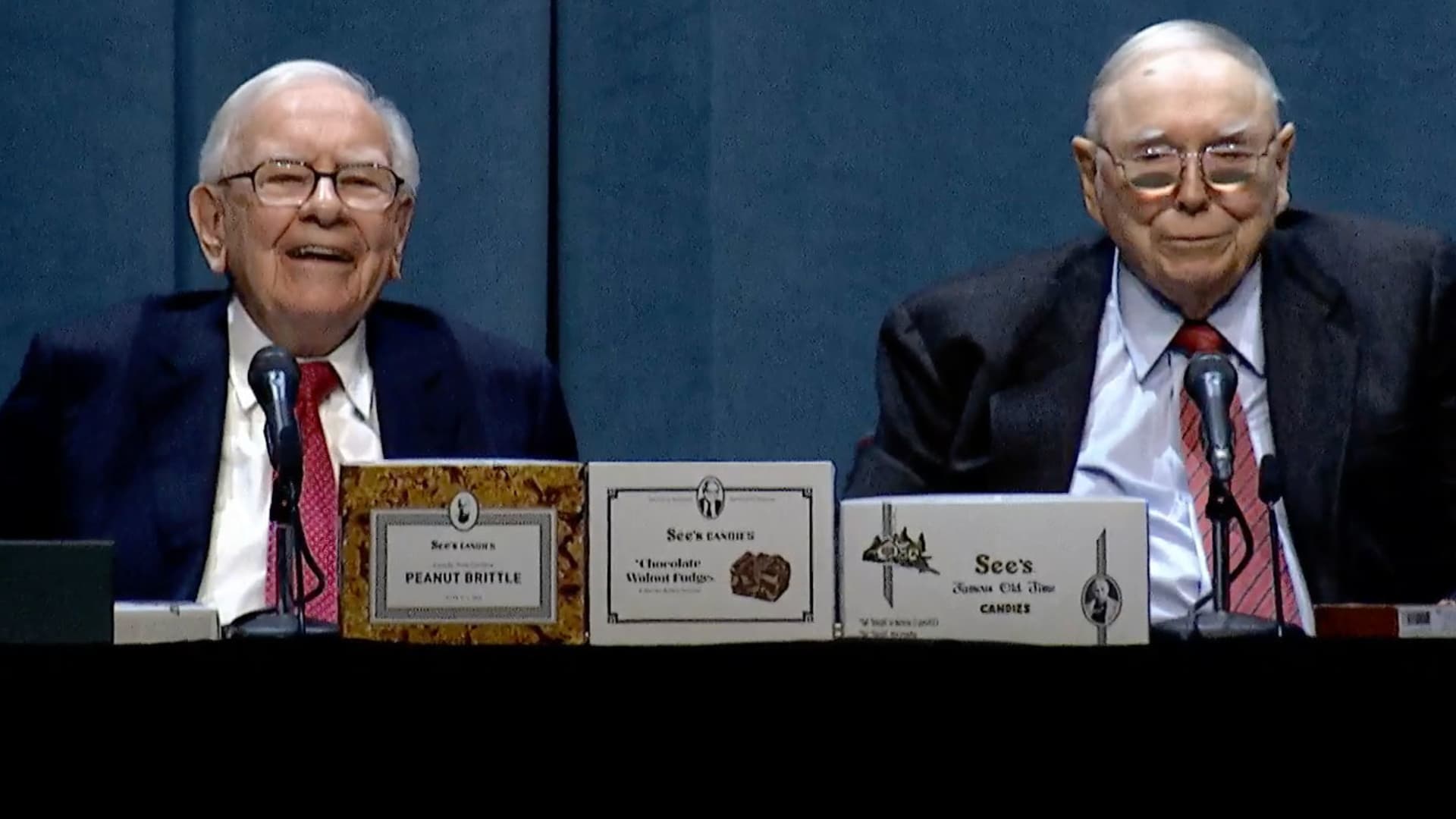

The Succession Plan and Its Potential Impact on Apple Holdings

The succession plan at Berkshire Hathaway, with Greg Abel and Ajit Jain poised to take on increased responsibilities, will significantly influence the future of its Apple holdings. While both Abel and Jain are highly regarded within the company, their individual investment philosophies may differ from Buffett's. Understanding their approaches is critical to predicting the future of Berkshire Hathaway Apple stock.

- Potential Scenarios: Abel and Jain's styles could lead to several scenarios, from maintaining the current stake, to a slight reduction, or even a significant shift in investment strategy. Each scenario will have different implications for Berkshire Hathaway Apple stock.

- Public Statements: Any public statements from Abel or Jain regarding their investment philosophy and future plans for Berkshire Hathaway's portfolio, including its Apple holdings, will be closely scrutinized by investors. These statements will directly impact the value of Buffett Apple stock.

- Potential Conflicts of Interest: It's crucial to analyze any potential conflicts of interest that might influence decisions regarding the Berkshire Hathaway Apple stock holdings. Transparency is key to maintaining investor confidence.

Factors Influencing a Potential Sale

Several factors could influence Berkshire Hathaway's decision regarding its Apple stock. These range from broader market conditions to Apple's own future performance and the risk tolerance of the new leadership team.

- Market Conditions: Economic downturns or market volatility could prompt Berkshire Hathaway to adjust its portfolio, potentially including its Apple holdings. Economic uncertainty always affects stock valuations, including Buffett Apple stock.

- Apple's Future Performance: Apple's future performance, including its ability to innovate and maintain its market leadership, is directly linked to the value of Berkshire Hathaway's investment. Any challenges or disruptions could impact the decision to sell or hold.

- Risk Tolerance: The risk tolerance of Berkshire Hathaway's new leadership will play a vital role in determining its investment strategy. A more risk-averse approach might lead to a reduction in high-growth, albeit potentially volatile, stocks such as Apple.

Alternative Scenarios: Holding or Increasing Apple Stock

It's equally plausible that Berkshire Hathaway will choose to retain or even increase its Apple stock holdings. The strategic advantages of maintaining a substantial stake in such a powerful technology company are considerable.

- Strategic Advantages: Maintaining a significant stake in Apple offers long-term growth potential and diversification benefits within the technology sector. Holding onto Buffett Apple stock maintains a key position in a leading tech company.

- Potential Collaborations: Future collaborations between Berkshire Hathaway and Apple could further incentivize maintaining or increasing the investment. Such collaborations could offer significant synergistic opportunities.

- Rationale for Increasing Holdings: If Apple continues its trajectory of innovation and growth, further investment by Berkshire Hathaway could be a strategic move to capitalize on its potential. Increasing holdings could also send a positive signal to the market about the future of both companies.

Conclusion

The future of Berkshire Hathaway's Apple stock after Buffett's departure remains uncertain. While a sale is a possibility, maintaining or even increasing the stake are equally plausible scenarios. The succession plan, the investment philosophies of Abel and Jain, and broader market conditions will all play a crucial role in determining the ultimate outcome. The key takeaway is the profound impact that Buffett's departure will have on the future management of Berkshire Hathaway's Apple investment and the implications for its overall investment strategy.

While only time will tell the ultimate fate of Berkshire Hathaway's Apple investment, staying informed about the company's strategic decisions is crucial. Keep monitoring news and analysis on Berkshire Hathaway's Apple stock and other investment strategies to stay ahead of the market. Learn more about the implications of Buffett's departure on Berkshire Hathaway Apple stock to make informed investment decisions.

Featured Posts

-

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Artistami

May 24, 2025

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Artistami

May 24, 2025 -

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025 -

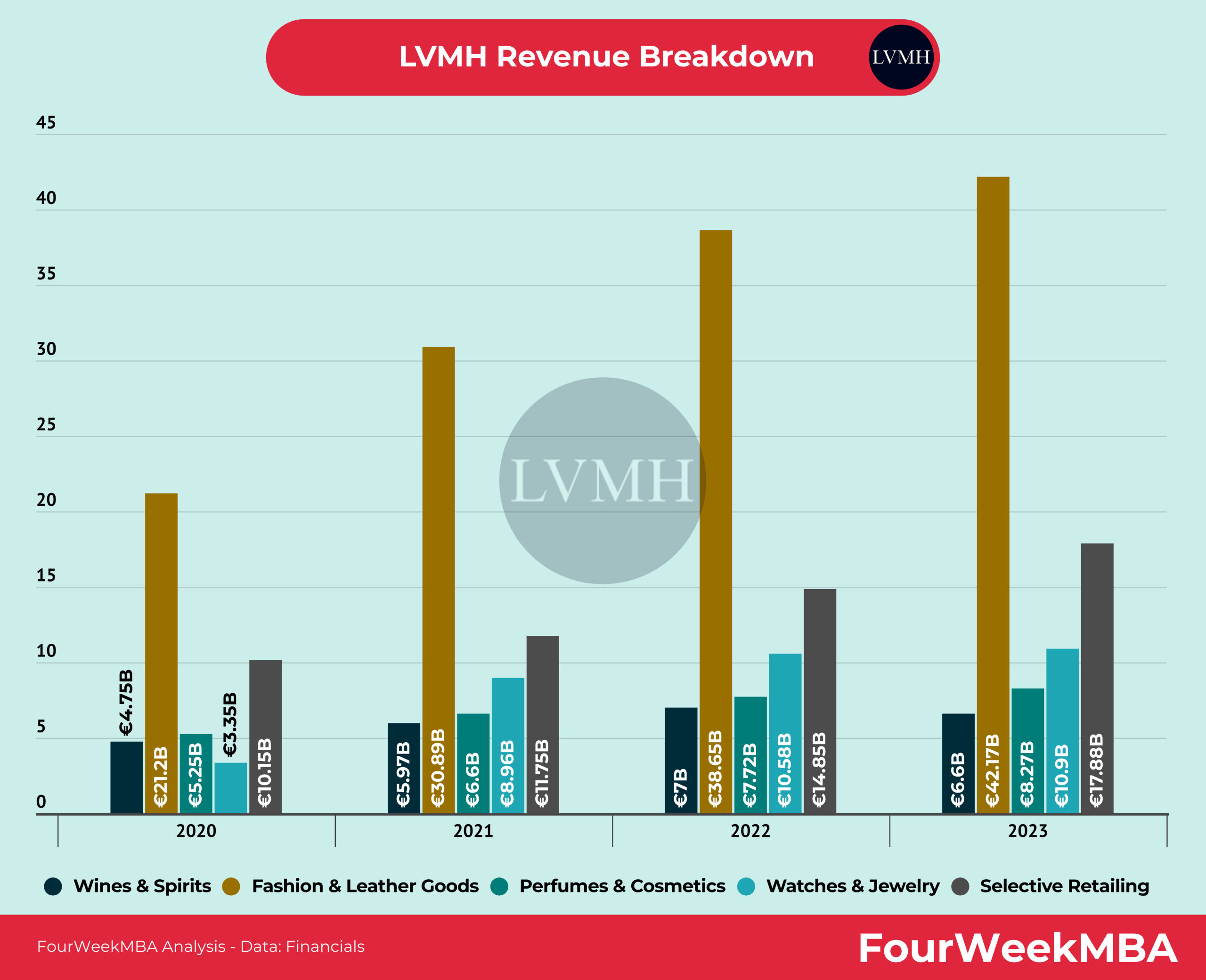

Lvmh Stock Falls 8 2 After Q1 Revenue Disappoints

May 24, 2025

Lvmh Stock Falls 8 2 After Q1 Revenue Disappoints

May 24, 2025 -

Tathyr Atfaq Washntn Bkyn Altjary Ela Mwshr Daks Alalmany

May 24, 2025

Tathyr Atfaq Washntn Bkyn Altjary Ela Mwshr Daks Alalmany

May 24, 2025 -

She Still Waiting By The Phone A Story Of Unrequited Love

May 24, 2025

She Still Waiting By The Phone A Story Of Unrequited Love

May 24, 2025

Latest Posts

-

Tva Group Restructuring 30 Job Losses Announced Due To Industry Challenges

May 24, 2025

Tva Group Restructuring 30 Job Losses Announced Due To Industry Challenges

May 24, 2025 -

Tva Group Ceo Blames Streamers And Regulators For 30 Job Cuts

May 24, 2025

Tva Group Ceo Blames Streamers And Regulators For 30 Job Cuts

May 24, 2025 -

Bitcoin Hits All Time High Amidst Positive Us Regulatory Outlook

May 24, 2025

Bitcoin Hits All Time High Amidst Positive Us Regulatory Outlook

May 24, 2025 -

Posthaste Analysis The Looming Crisis In The Global Bond Market

May 24, 2025

Posthaste Analysis The Looming Crisis In The Global Bond Market

May 24, 2025 -

Tva Group Layoffs 30 Jobs Cut Amid Streaming Competition And Regulatory Pressure

May 24, 2025

Tva Group Layoffs 30 Jobs Cut Amid Streaming Competition And Regulatory Pressure

May 24, 2025