ABN Amro Facing Investigation: Dutch Central Bank Scrutinizes Bonus Practices

Table of Contents

The Scope of the DNB Investigation

The DNB's investigation into ABN Amro's bonus system is far-reaching, focusing on several key aspects of regulatory compliance. The investigation aims to determine whether the bank's compensation structure adheres to Dutch and European Union regulations concerning responsible banking practices. Specifically, the DNB is examining the following:

-

Alignment with Responsible Banking Practices: The DNB is scrutinizing whether ABN Amro's bonus system adequately incentivizes responsible risk-taking and aligns with ethical conduct standards. This includes assessing whether the system promotes long-term stability over short-term gains.

-

Transparency and Accuracy of Reporting: The investigation assesses the transparency and accuracy of ABN Amro's reporting of bonus payments. Any discrepancies or inconsistencies could lead to further scrutiny and potential penalties.

-

Potential for Financial Penalties: The consequences of non-compliance are significant. The DNB could impose substantial financial penalties on ABN Amro, impacting the bank's profitability and financial stability.

Concerns Regarding Bonus Culture and Risk-Taking

The DNB's investigation into ABN Amro's bonus practices stems from broader concerns regarding bonus culture and its potential impact on risk-taking within the financial sector. Critics argue that excessive bonus payments can encourage reckless behavior, prioritizing short-term profits over long-term sustainability. This investigation seeks to address these concerns specifically within ABN Amro’s structure.

-

Incentivizing Excessive Risk: The DNB is investigating whether ABN Amro's bonus system inadvertently incentivizes employees to take on excessive risks to maximize short-term bonuses, potentially endangering the bank's financial health and stability.

-

Conflicts of Interest: Concerns exist regarding potential conflicts of interest embedded within ABN Amro's compensation structure. The DNB will analyze whether the system inadvertently encourages decisions that benefit individual employees at the expense of the bank or its stakeholders.

-

Wider European Trend: The DNB's action reflects a broader trend across the European banking sector toward increased regulatory scrutiny of bonus practices. Many regulators are now striving to create a more balanced approach to executive compensation that aligns incentives with responsible risk management.

Potential Implications for ABN Amro and the Dutch Banking Sector

The outcome of the DNB investigation will have far-reaching implications for both ABN Amro and the Dutch banking sector as a whole. The potential consequences are substantial and far-reaching.

-

Reputational Damage: Negative publicity surrounding the investigation could severely damage ABN Amro's reputation, leading to a loss of investor confidence and potential difficulties attracting and retaining talented employees.

-

Substantial Financial Penalties: If found to be in violation of regulations, ABN Amro could face hefty financial penalties, impacting its profitability and shareholder value.

-

Regulatory Reform within ABN Amro and the Broader Sector: The investigation could trigger significant internal reforms at ABN Amro, leading to changes in its compensation policies and internal risk management processes. Furthermore, it may also serve as a catalyst for wider regulatory reforms within the Dutch banking sector, impacting all financial institutions operating within the Netherlands.

Conclusion

The DNB's investigation into ABN Amro's bonus practices underscores the increasing emphasis on ethical conduct and responsible risk-taking within the financial industry. The potential consequences – substantial financial penalties, reputational damage, and potential regulatory reform – highlight the critical importance of transparent and equitable compensation structures within the banking sector. The implications extend beyond ABN Amro, potentially shaping regulatory landscapes and ethical practices within the entire Dutch banking sector. Stay informed about the ongoing ABN Amro investigation and the broader discussion surrounding ethical bonus practices in the Dutch banking sector. Continued scrutiny of ABN Amro's bonus practices is crucial for maintaining the integrity and stability of the financial system.

Featured Posts

-

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 22, 2025

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 22, 2025 -

The Downfall A Ceo Love Affair And Its Corporate Consequences

May 22, 2025

The Downfall A Ceo Love Affair And Its Corporate Consequences

May 22, 2025 -

Massive V Mware Price Hike At And T Faces 1 050 Increase Due To Broadcom

May 22, 2025

Massive V Mware Price Hike At And T Faces 1 050 Increase Due To Broadcom

May 22, 2025 -

Where To Invest A Comprehensive Guide To The Countrys Rising Business Centers

May 22, 2025

Where To Invest A Comprehensive Guide To The Countrys Rising Business Centers

May 22, 2025 -

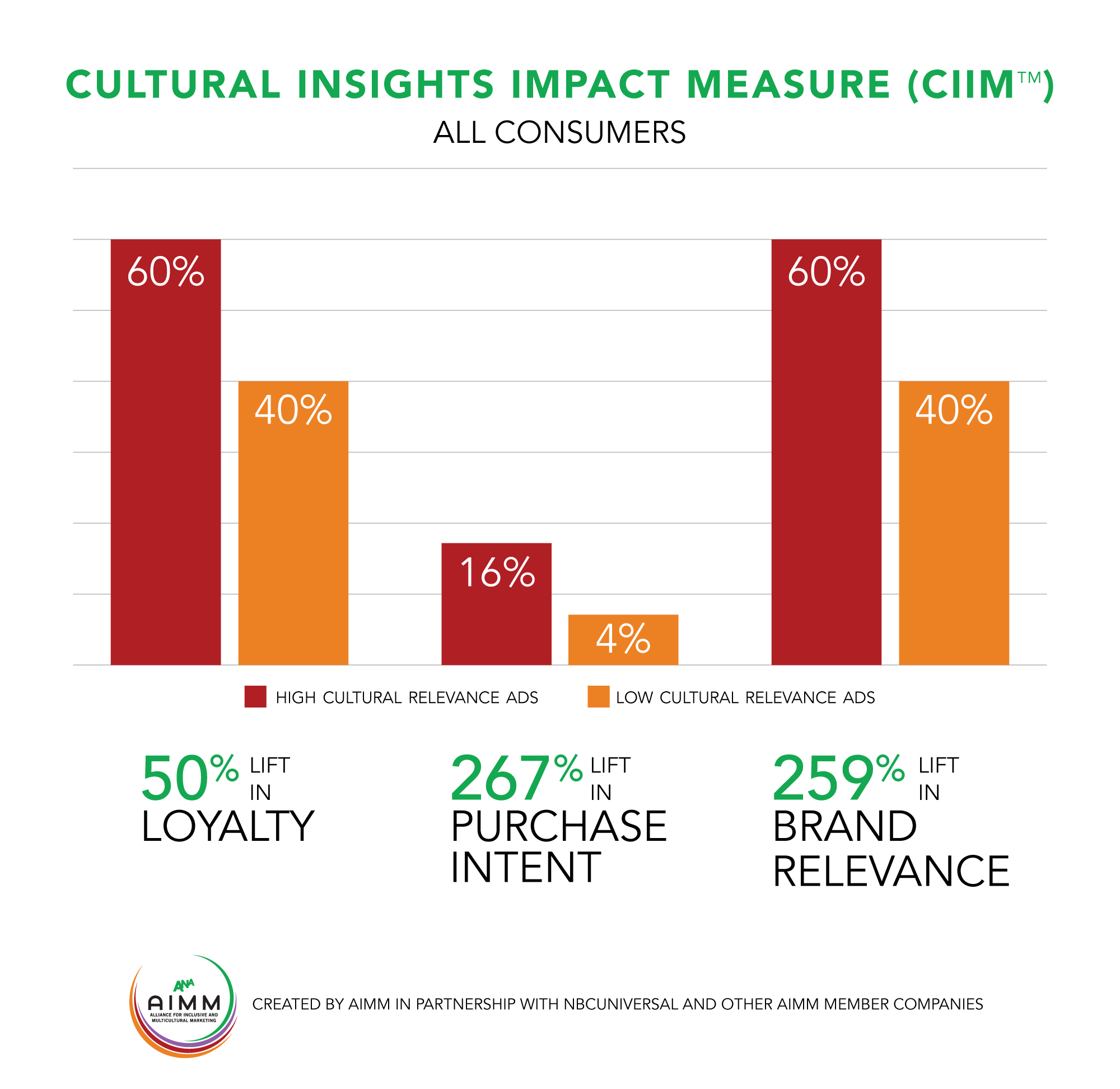

The Goldbergs The Shows Impact And Cultural Relevance

May 22, 2025

The Goldbergs The Shows Impact And Cultural Relevance

May 22, 2025

Latest Posts

-

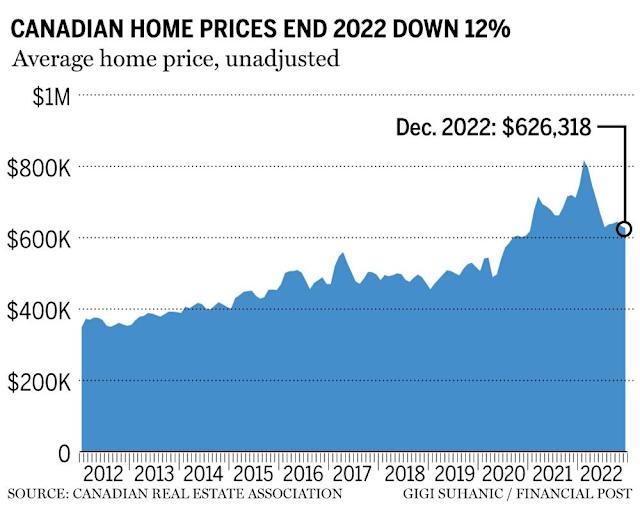

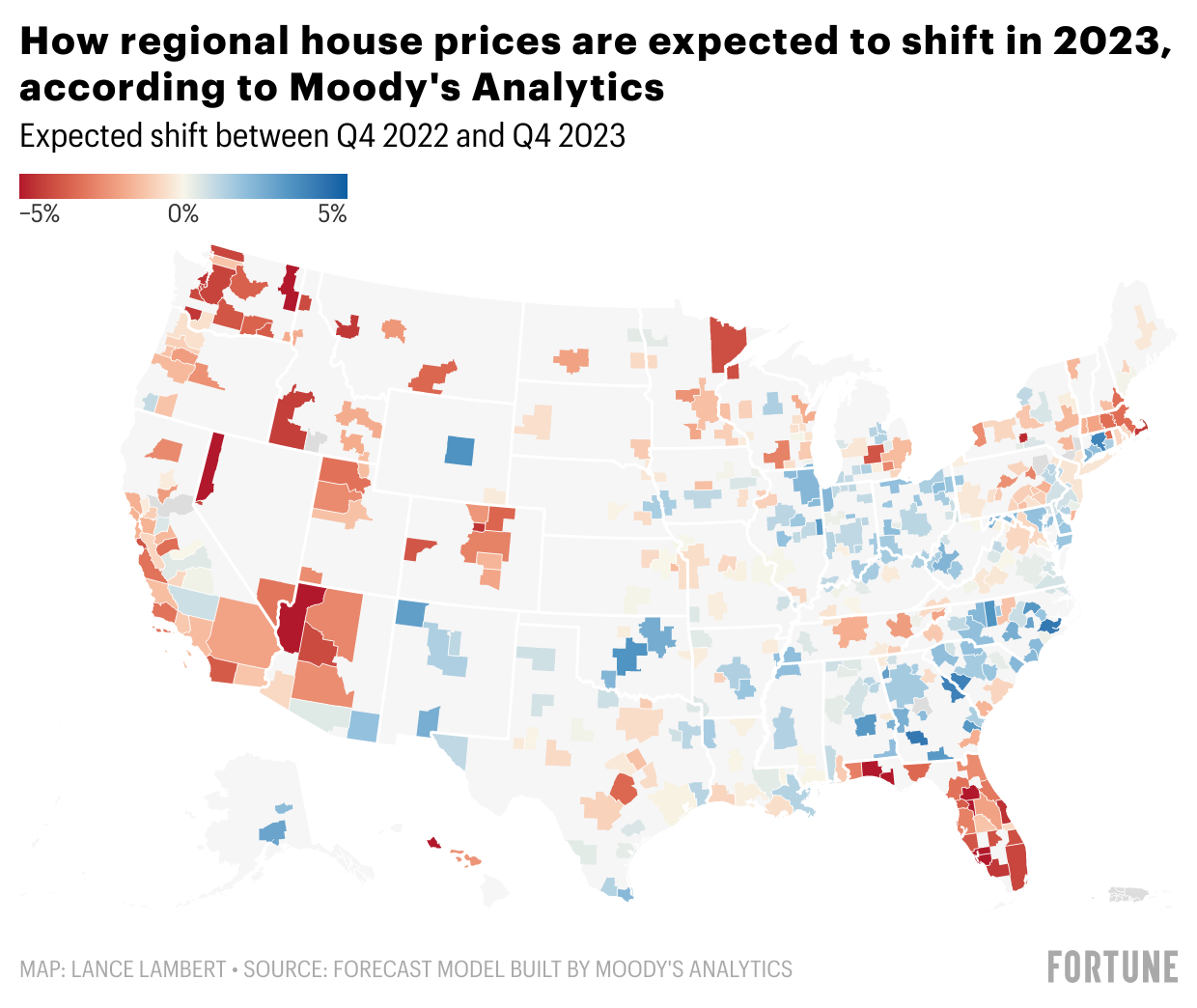

Is A Housing Market Correction Imminent In Canada Posthaste Analysis

May 22, 2025

Is A Housing Market Correction Imminent In Canada Posthaste Analysis

May 22, 2025 -

Canadas Housing Market Signs Of A Price Correction

May 22, 2025

Canadas Housing Market Signs Of A Price Correction

May 22, 2025 -

Canadian Home Prices Correction On The Horizon

May 22, 2025

Canadian Home Prices Correction On The Horizon

May 22, 2025 -

Home Depot Earnings Maintaining Guidance Amidst Challenges

May 22, 2025

Home Depot Earnings Maintaining Guidance Amidst Challenges

May 22, 2025 -

Home Depots Financial Performance Disappointment And Tariff Considerations

May 22, 2025

Home Depots Financial Performance Disappointment And Tariff Considerations

May 22, 2025