Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the current market value of an ETF's underlying assets, less its liabilities, divided by the number of outstanding shares. It's a crucial metric for assessing the intrinsic value of an exchange-traded fund (ETF). Think of it as the theoretical price per share you'd receive if the ETF were liquidated today. Accurate asset pricing is fundamental to NAV calculation.

- NAV is calculated daily, usually at the market close, reflecting the closing prices of the underlying assets.

- It represents the theoretical price per share if the ETF were liquidated, providing a snapshot of its current worth.

- It takes into account all assets held by the ETF, including stocks, bonds, or other securities, minus any liabilities like management fees.

- Understanding NAV helps assess the ETF's performance and compare it to its benchmark index and other similar investments.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

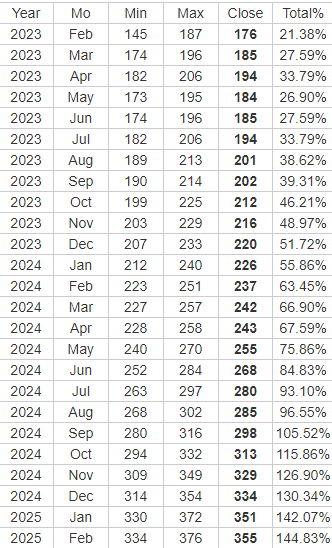

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily using a specific methodology designed to accurately reflect the value of its underlying assets. Because this ETF tracks the Dow Jones Industrial Average, its NAV is intrinsically linked to the index's performance.

- The ETF tracks the Dow Jones Industrial Average: This means its portfolio mirrors the composition of the index, holding shares in the same 30 companies with similar weightings.

- The calculation considers the market value of each component stock in the Dow Jones Industrial Average. The closing price of each stock is multiplied by the number of shares held by the ETF.

- Currency exchange rates (if applicable) are factored into the calculation. While the Dow Jones Industrial Average is US-dollar denominated, any currency fluctuations impacting the ETF's holdings are accounted for.

- Any expenses or liabilities of the ETF are deducted from the total asset value. This includes management fees, administrative costs, and any other expenses incurred by the fund.

The Importance of NAV for Amundi Dow Jones Industrial Average UCITS ETF Investors

Monitoring the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investment is crucial for several reasons. It provides essential insights into your investment's performance and helps inform your investment strategy.

- Track your investment's growth or decline: By comparing the daily NAV, you can easily see how your investment has performed over time.

- Compare the ETF's performance against its benchmark (Dow Jones Industrial Average): This helps determine how effectively the ETF is tracking its index.

- Identify potential buying or selling opportunities: Changes in NAV can signal potential entry or exit points for your investment, though other factors should also be considered.

- Assess the effectiveness of your investment strategy: Consistent NAV monitoring allows you to evaluate whether your investment approach is achieving your financial goals.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Accessing the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this crucial data.

- The Amundi website: Amundi, the fund manager, typically publishes daily NAV data on their official website.

- Major financial news websites: Many reputable financial news sources provide real-time or delayed NAV information for ETFs.

- Your brokerage account: Most brokerage platforms display the current NAV of your ETF holdings directly within your account.

- Dedicated ETF data providers: Specialized financial data providers offer comprehensive ETF information, including NAV data.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for any investor seeking exposure to this iconic index. By regularly monitoring the NAV, you can effectively track your investment's performance, compare it against the benchmark, and make informed decisions about your portfolio. Learn more about Amundi Dow Jones Industrial Average UCITS ETF NAV and optimize your investment strategy today! Regularly checking your Amundi Dow Jones Industrial Average UCITS ETF's NAV is key to successful investing.

Featured Posts

-

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025 -

Will Wall Streets Recovery Undermine Germanys Dax Rally

May 24, 2025

Will Wall Streets Recovery Undermine Germanys Dax Rally

May 24, 2025 -

Avrupa Borsalarinda Karisik Seans Guenuen Oezeti

May 24, 2025

Avrupa Borsalarinda Karisik Seans Guenuen Oezeti

May 24, 2025 -

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 24, 2025 -

Planning Your Memorial Day Trip 2025 Flight Dates To Consider

May 24, 2025

Planning Your Memorial Day Trip 2025 Flight Dates To Consider

May 24, 2025

Latest Posts

-

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025 -

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025