Canadian Gold Corp Secures $300,000 For Tartan Mine NI 43-101 & PEA

Table of Contents

The Significance of the $300,000 Investment for the Tartan Mine Project

The $300,000 secured by Canadian Gold Corp is not merely a financial boost; it's a catalyst for significant progress at the Tartan Mine. This investment directly translates into tangible advancements, moving the project closer to potential production. The funds will be strategically allocated to several key areas:

- Funding for NI 43-101 compliant resource estimate updates: This ensures the accuracy and reliability of the resource estimate, a crucial factor in attracting further investment and securing future financing.

- Completion of the Preliminary Economic Assessment (PEA): The PEA will provide a comprehensive evaluation of the project's economic viability, including projected costs and potential returns. This is a critical step towards making informed decisions about the project's future development.

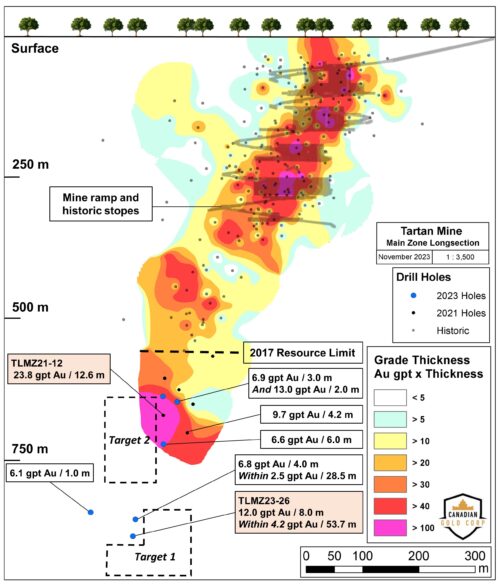

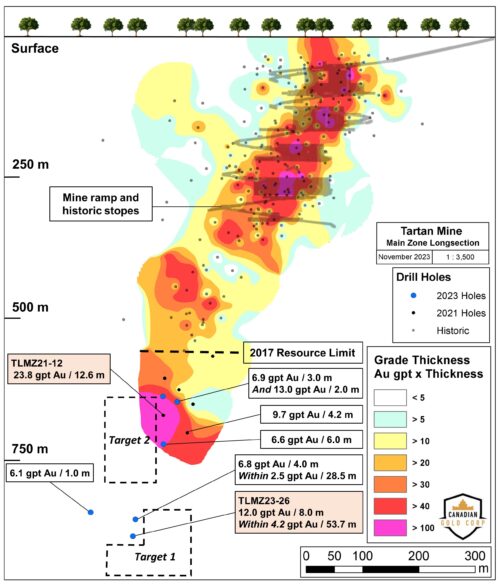

- Continued exploration activities at the Tartan Mine: Further exploration will help refine the understanding of the mine's resource potential and potentially expand the known reserves.

- Potential for attracting further investment based on positive PEA results: A successful PEA will significantly enhance the project’s attractiveness to potential investors, potentially leading to larger funding rounds and accelerated development.

Understanding the NI 43-101 Resource Estimate and its Importance

A NI 43-101 compliant resource estimate is a critical component in the development of any mining project, especially for attracting investors. This industry standard, mandated in Canada, requires a technical report prepared by qualified professionals that details the geological data, resource estimation methodology, and an independent verification of the resource. This rigorous process ensures transparency and credibility.

- Detailed explanation of the technical report requirements: The NI 43-101 standard outlines specific requirements for the technical report, ensuring a high level of accuracy and detail in the resource estimate.

- Emphasis on the reliability and credibility of the resource estimate: The independent verification process significantly enhances the reliability and credibility of the resource estimate, giving investors confidence in the project's potential.

- Mentioning the potential impact on future financing rounds: A robust and well-supported NI 43-101 compliant resource estimate is essential for securing further financing and attracting investors in future funding rounds.

The Preliminary Economic Assessment (PEA) and its Implications for Tartan Mine

The Preliminary Economic Assessment (PEA) is a crucial step in determining the economic viability of the Tartan Mine. It provides a high-level analysis of the project's potential profitability, taking into account various factors:

- Projected production rates and timelines: The PEA will project the likely production rates and timelines for the Tartan Mine, offering a realistic view of the project's potential output.

- Estimated operating costs and profitability analysis: This analysis will detail the estimated operating costs, including labor, materials, and other expenses, and will provide a comprehensive assessment of the project's potential profitability.

- Potential return on investment (ROI) for investors: A key component of the PEA is the projected return on investment, helping investors assess the risks and potential rewards of investing in the Tartan Mine.

- Environmental impact assessment considerations: The PEA will also include an assessment of the environmental impact of the project, highlighting the company's commitment to responsible and sustainable mining practices.

Canadian Gold Corp's Strategy and Future Outlook

Canadian Gold Corp's strategy focuses on responsible development of the Tartan Mine, leveraging the current investment to unlock its full potential. The company plans to continue exploring opportunities for resource expansion and production increases, while adhering to stringent environmental standards.

- Long-term vision for the Tartan Mine: The company has a long-term vision for the Tartan Mine, aiming to establish it as a significant gold producer.

- Potential for resource expansion and production increase: Ongoing exploration activities have the potential to significantly expand the known resources at the Tartan Mine, leading to higher production levels.

- The company’s commitment to responsible mining practices: Canadian Gold Corp is committed to responsible mining practices, minimizing environmental impact and maximizing benefits for local communities.

Conclusion: Investing in the Future with Canadian Gold Corp's Tartan Mine

The successful securing of $300,000 is a significant milestone for Canadian Gold Corp and its Tartan Mine project. The funding will directly support the completion of a NI 43-101 compliant resource estimate and a comprehensive PEA, crucial steps in advancing the project toward production. This investment highlights the considerable potential of the Tartan Mine and positions Canadian Gold Corp for further growth and success. Learn more about this exciting Canadian Gold Corp investment opportunity and other NI 43-101 compliant projects by visiting their website or contacting the company directly. Consider the Tartan Mine investment opportunity and explore how you can be a part of this promising venture.

Featured Posts

-

Us Visa Restrictions New Rules Target Social Media Censorship

May 30, 2025

Us Visa Restrictions New Rules Target Social Media Censorship

May 30, 2025 -

Oasis Concert Tickets Investigating Ticketmasters Compliance With Consumer Protection Regulations

May 30, 2025

Oasis Concert Tickets Investigating Ticketmasters Compliance With Consumer Protection Regulations

May 30, 2025 -

Bruno Fernandes Transfer Saga Al Hilals Latest Bid

May 30, 2025

Bruno Fernandes Transfer Saga Al Hilals Latest Bid

May 30, 2025 -

All New Air Jordans Coming In June 2025

May 30, 2025

All New Air Jordans Coming In June 2025

May 30, 2025 -

330 000 Marketing Contract Via Rails Push For High Speed Rail In Quebec

May 30, 2025

330 000 Marketing Contract Via Rails Push For High Speed Rail In Quebec

May 30, 2025

Latest Posts

-

Why Stretched Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 31, 2025

Why Stretched Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 31, 2025 -

Understanding Stock Market Valuations Bof As Take

May 31, 2025

Understanding Stock Market Valuations Bof As Take

May 31, 2025 -

High Stock Valuations Bof As Analysis And Investor Guidance

May 31, 2025

High Stock Valuations Bof As Analysis And Investor Guidance

May 31, 2025 -

Bof As Reassuring View Why High Stock Market Valuations Shouldnt Concern Investors

May 31, 2025

Bof As Reassuring View Why High Stock Market Valuations Shouldnt Concern Investors

May 31, 2025 -

How Middle Management Drives Productivity And Improves Employee Well Being

May 31, 2025

How Middle Management Drives Productivity And Improves Employee Well Being

May 31, 2025