Dubai Holding Increases REIT IPO To $584 Million

Table of Contents

Reasons Behind the Increased IPO Value

The substantial increase in the Dubai Holding REIT IPO value from its initially projected amount can be attributed to several key factors. The robust demand from investors reflects a positive outlook on Dubai's real estate market, driven by strong economic fundamentals and the emirate's strategic location.

- Strong demand from investors: The significant oversubscription of the IPO highlights the strong appetite for investment opportunities within Dubai's property sector. Both local and international investors see considerable potential for growth and high returns.

- Positive outlook for Dubai's real estate market: Dubai's real estate market has shown remarkable resilience and consistent growth, attracting significant foreign investment. The ongoing infrastructure development and government initiatives further enhance investor confidence.

- Attractive yields offered by the REIT: The Dubai Holding REIT offers a competitive dividend yield, making it an attractive proposition for income-seeking investors. This ensures a steady stream of returns, further boosting its appeal.

- Strategic positioning of Dubai Holding's assets: The REIT's portfolio comprises prime real estate assets strategically located across high-demand areas in Dubai. This prime location significantly enhances the investment's value and long-term prospects.

Details of the Dubai Holding REIT Offering

The Dubai Holding REIT offering includes a diversified portfolio of high-quality commercial and residential properties, carefully selected to maximize returns for investors.

- List of key properties included in the REIT: While a full list might not be publicly available immediately after the IPO, it's expected that the portfolio includes a mix of iconic and well-established properties across various sectors. This diversification minimizes risk and maximizes potential returns.

- Projected dividend yield: The projected dividend yield is a crucial factor attracting investors. A strong, consistent yield is a key selling point for any REIT investment.

- Management team and their expertise: The experienced management team brings a wealth of expertise in real estate investment and management, assuring investors of competent oversight and strategic decision-making.

- IPO timeline and key dates: Investors interested in participating should carefully monitor the official timeline for the IPO to ensure timely participation in this exciting opportunity.

Impact on Dubai's Economy and Real Estate Market

The success of the Dubai Holding REIT IPO carries significant implications for Dubai's economy and real estate market. The substantial investment injection will have a ripple effect across various sectors.

- Increased foreign direct investment (FDI): The IPO's success will likely attract further foreign investment into Dubai, strengthening its position as a global financial center.

- Job creation potential: The growth of the REIT sector will inevitably lead to the creation of new jobs across various fields, contributing to economic growth and development.

- Boost to the overall Dubai economy: The influx of capital and the increased economic activity associated with the REIT will stimulate the overall Dubai economy, contributing to its sustainable growth.

- Potential for further REIT developments in Dubai: This successful IPO could pave the way for more REIT developments in Dubai, further diversifying the investment landscape and attracting additional investment.

Investor Sentiment and Market Analysis

The market response to the increased IPO value has been overwhelmingly positive. Analysts and investors alike see this as a strong indicator of confidence in Dubai's continued economic growth.

- Analyst ratings and forecasts: Many financial analysts have issued positive ratings and forecasts for the Dubai Holding REIT, anticipating strong performance and significant returns for investors.

- Investor reaction and market response: The market response has been extremely positive, with strong demand driving the IPO value significantly higher than initially projected.

- Comparison with other REIT offerings in the region: Compared to other REIT offerings in the region, the Dubai Holding REIT stands out due to its strategic asset location, diversified portfolio, and projected yield.

- Risk assessment of the investment: As with any investment, there are inherent risks. However, a thorough risk assessment should be undertaken by potential investors before committing capital.

Conclusion: Investing in Dubai's Booming Real Estate Market with the Dubai Holding REIT IPO

The Dubai Holding REIT IPO's surge to $584 million underscores the remarkable investor confidence in Dubai's real estate market. This success is fueled by strong demand, positive market outlook, attractive yields, and the strategic positioning of the REIT's assets. The substantial investment will have a significant positive impact on Dubai's economy, attracting further FDI and boosting overall growth. For investors, the Dubai Holding REIT presents a compelling opportunity to participate in Dubai's booming real estate sector. Learn more about this exciting investment opportunity and explore the Dubai Holding REIT. Don't miss out on this substantial REIT offering!

Featured Posts

-

Mas Alla Del Arandano El Mejor Superalimento Para Prevenir Enfermedades

May 21, 2025

Mas Alla Del Arandano El Mejor Superalimento Para Prevenir Enfermedades

May 21, 2025 -

19 Indian Paddlers Make History At Wtt Star Contender Chennai

May 21, 2025

19 Indian Paddlers Make History At Wtt Star Contender Chennai

May 21, 2025 -

Klopps Future Agents Remarks On Potential Real Madrid Move

May 21, 2025

Klopps Future Agents Remarks On Potential Real Madrid Move

May 21, 2025 -

La Rental Market Exploits Price Gouging After Recent Fires

May 21, 2025

La Rental Market Exploits Price Gouging After Recent Fires

May 21, 2025 -

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Latest Posts

-

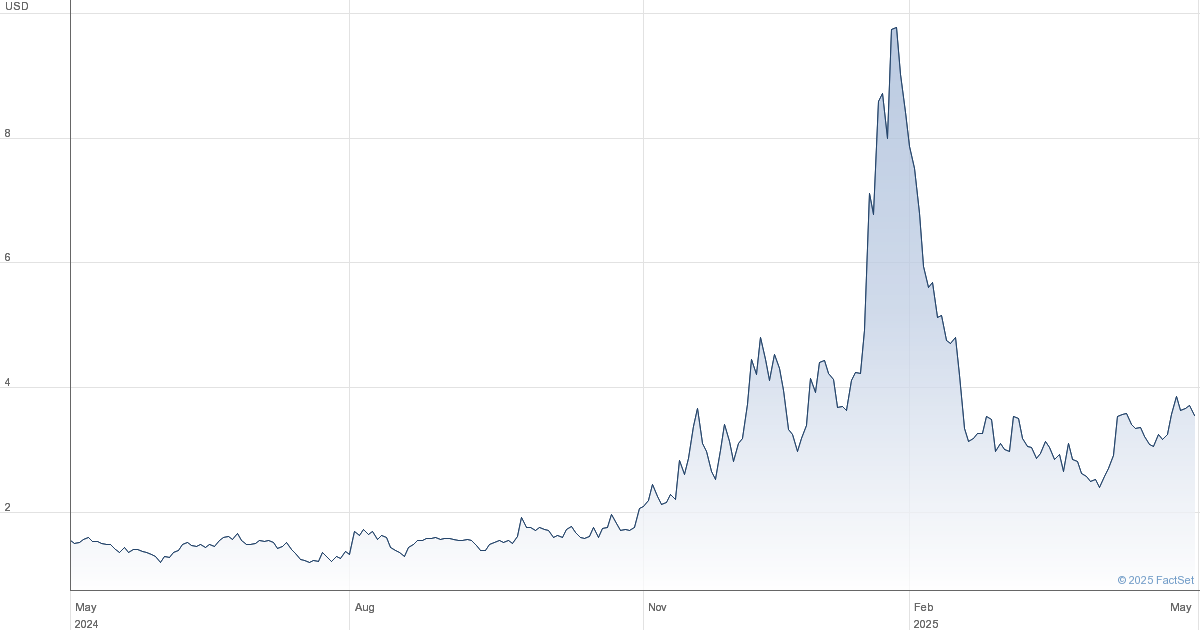

Big Bear Ai Bbai Investors Contact Gross Law Firm Before June 10 2025

May 21, 2025

Big Bear Ai Bbai Investors Contact Gross Law Firm Before June 10 2025

May 21, 2025 -

Big Bear Ai Bbai Shares Fall On Weak Q1 Results

May 21, 2025

Big Bear Ai Bbai Shares Fall On Weak Q1 Results

May 21, 2025 -

Big Bear Ai Sued A Deep Dive Into The Securities Law Allegations

May 21, 2025

Big Bear Ai Sued A Deep Dive Into The Securities Law Allegations

May 21, 2025 -

Big Bear Ai Stock Plunges Following Disappointing Q1 Earnings

May 21, 2025

Big Bear Ai Stock Plunges Following Disappointing Q1 Earnings

May 21, 2025 -

Big Bear Ai Holdings Inc Faces Securities Lawsuit What Investors Need To Know

May 21, 2025

Big Bear Ai Holdings Inc Faces Securities Lawsuit What Investors Need To Know

May 21, 2025