Indian Insurers Push For Relaxed Bond Forward Regulations

Table of Contents

Current Bond Forward Regulations and Their Impact on Indian Insurers

India's current bond forward regulations, designed to mitigate market risks, impose significant limitations on insurance companies' investment strategies. These regulations often dictate permissible investment vehicles, maturity periods, and overall exposure limits within the bond forward market. This creates several challenges for Indian insurers:

- Limited Investment Options: Stringent regulations restrict the types of bonds insurers can invest in, limiting diversification opportunities and potential returns. This impacts their ability to optimize their investment portfolios and achieve optimal risk-adjusted returns.

- Reduced Profitability: The inability to access a wider range of investment instruments, including potentially higher-yielding bond forwards, directly impacts profitability and return on investment (ROI). This reduces the overall competitiveness of the Indian insurance sector.

- Increased Risk Management Complexities: Navigating the complex regulatory framework adds to operational costs and necessitates sophisticated risk management strategies, increasing the burden on already resource-constrained insurers. This necessitates specialized expertise in risk management in insurance and compliance.

- Impact on Hedging Strategies: Restrictions limit the use of bond forwards for effective hedging against interest rate risk and other market uncertainties, leaving insurers more vulnerable to market fluctuations. The Indian insurance regulations effectively limit their ability to utilize sophisticated risk mitigation techniques.

Arguments for Relaxed Regulations: Benefits for the Insurance Sector

Indian insurers argue that relaxing bond forward regulations would significantly benefit the sector. Their key arguments include:

- Increased Investment Flexibility: Easing restrictions would allow insurers to diversify their investments, optimizing portfolios for higher returns while managing risk effectively. This would facilitate a more dynamic and efficient allocation of capital within the Indian financial market.

- Improved Profitability and Return on Investment: Access to a broader range of bond forward instruments could lead to significantly improved profitability and ROI, enhancing the sector's overall financial strength. This enhanced profitability would boost the sector's competitiveness within the global insurance landscape.

- Enhanced Ability to Manage Risks Effectively: Relaxed regulations would allow insurers to employ more sophisticated hedging strategies, reducing their vulnerability to market volatility and improving financial stability. This aligns with global best practices in risk mitigation and insurance investment.

- Greater Competitiveness with Global Players: By aligning Indian regulations with international standards, domestic insurers would become more competitive, attracting foreign investment and boosting growth within the sector. This market liberalization would facilitate increased participation within the bond forward market.

Potential Risks and Concerns Associated with Relaxation

While the benefits of relaxed regulations are substantial, potential downsides must be addressed. These include:

- Increased Market Volatility: Greater flexibility in investment strategies could potentially increase market volatility if not managed properly. This underscores the critical need for robust regulatory oversight.

- Potential for Misuse or Excessive Risk-Taking: Relaxing regulations carries the risk of insurers engaging in excessive risk-taking, potentially jeopardizing policyholder funds. This highlights the importance of stringent financial regulation.

- Need for Robust Regulatory Oversight: To mitigate these risks, a strengthened regulatory framework is essential, focusing on transparency, disclosure, and effective surveillance. Comprehensive risk management frameworks and improved insurance supervision are crucial for safeguarding the financial stability of the sector. Strengthened regulatory oversight is paramount to preventing any misuse of the relaxed regulations.

Government's Stance and Future Outlook for Bond Forward Regulations

The Indian government's current stance on bond forward regulations remains cautious. While there's recognition of the need for increased competitiveness within the insurance sector, concerns about systemic risk persist. Future scenarios will likely depend on the careful balancing of growth and stability. Any substantial changes to government policy will require a comprehensive assessment of potential impacts and robust mitigation strategies. Ongoing dialogue and consultations between regulators and industry stakeholders are expected to shape the future of insurance in India. Recent discussions indicate a potential for phased relaxation, coupled with enhanced regulatory changes and increased transparency.

Conclusion: The Need for Balanced Regulation in the Indian Insurance Sector

The debate surrounding Indian insurers' push for relaxed bond forward regulations highlights the crucial need to strike a balance between fostering growth and maintaining financial stability. While easing regulations offers significant potential benefits, addressing potential risks through robust regulatory oversight is paramount. A well-defined regulatory framework that promotes flexibility and competitiveness while incorporating effective risk management measures is crucial for the continued growth and stability of the Indian insurance sector. We encourage you to engage in this important discussion. Contact your representatives and participate in industry forums to shape the future of Indian insurance regulations and contribute to a more robust and competitive financial landscape.

Featured Posts

-

Dogovor Mezhdu Frantsiey I Polshey Detali Soglasheniya Makrona I Tuska

May 09, 2025

Dogovor Mezhdu Frantsiey I Polshey Detali Soglasheniya Makrona I Tuska

May 09, 2025 -

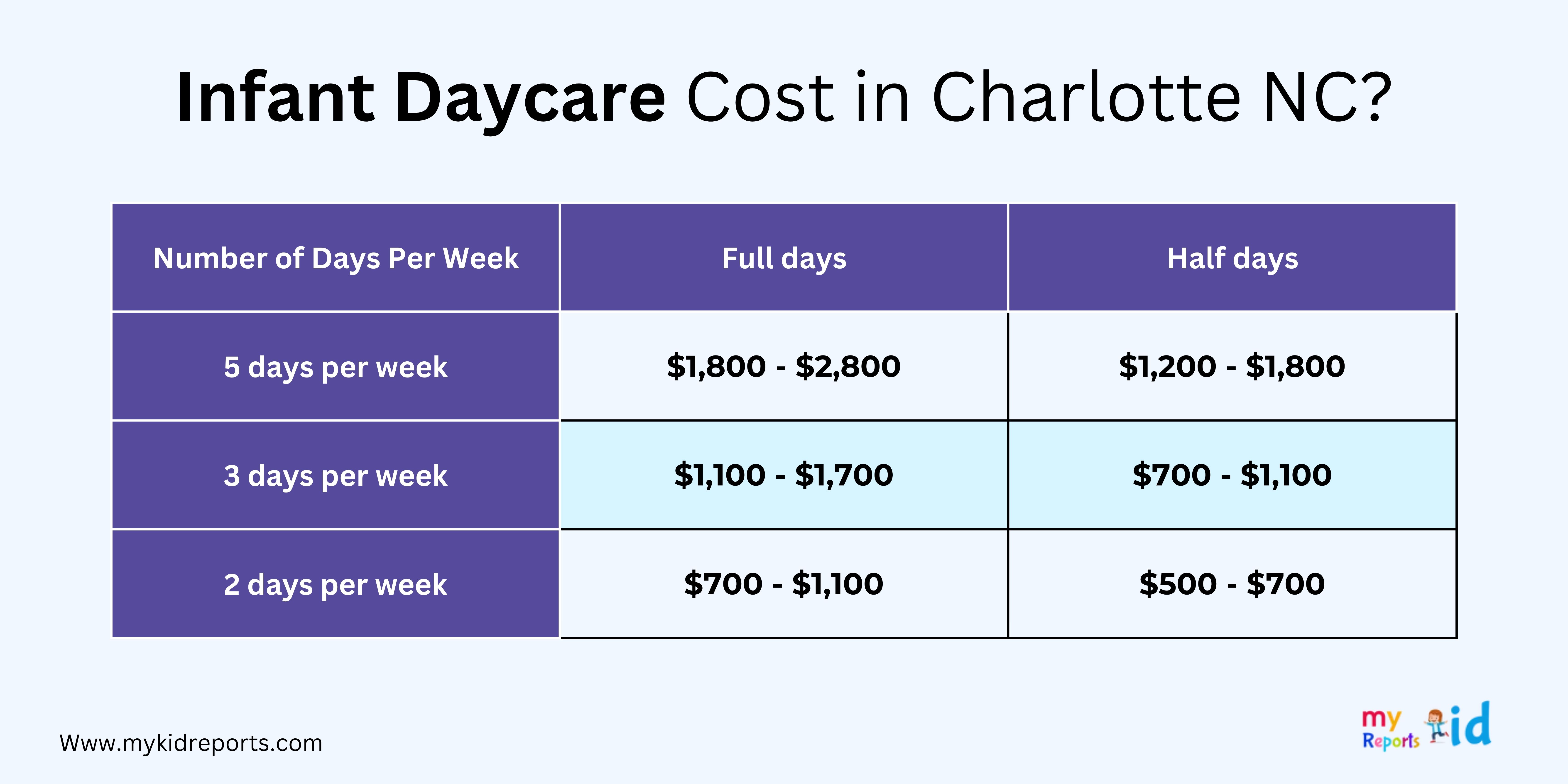

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025 -

Pley Off Vegas Golden Nayts Obygryvaet Minnesotu V Overtayme

May 09, 2025

Pley Off Vegas Golden Nayts Obygryvaet Minnesotu V Overtayme

May 09, 2025 -

32

May 09, 2025

32

May 09, 2025 -

Should You Invest In This Spac Rivaling Micro Strategy Risk Vs Reward

May 09, 2025

Should You Invest In This Spac Rivaling Micro Strategy Risk Vs Reward

May 09, 2025

Latest Posts

-

Disneys Positive Profit Revision Parks And Streaming Fueling Growth

May 10, 2025

Disneys Positive Profit Revision Parks And Streaming Fueling Growth

May 10, 2025 -

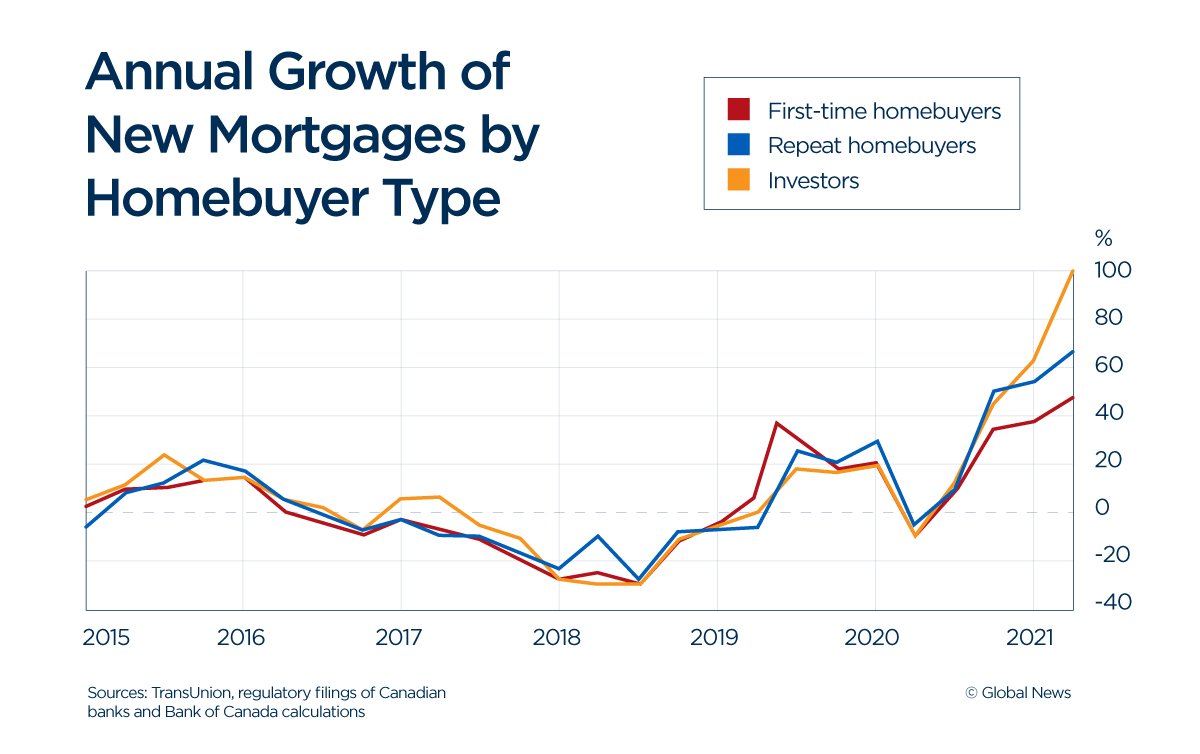

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025

Canadas Housing Market The Impact Of Steep Down Payments

May 10, 2025 -

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025

Pam Bondi Accused Of Hiding Epstein Records Senate Democrats Speak Out

May 10, 2025 -

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025 -

Posthaste High Down Payments And The Canadian Housing Crisis

May 10, 2025

Posthaste High Down Payments And The Canadian Housing Crisis

May 10, 2025