Where To Invest Now: A Data-Driven Map Of Promising Business Locations

Table of Contents

Analyzing Economic Indicators for Investment Decisions

Making sound investment decisions requires a thorough understanding of key economic indicators. These indicators provide valuable insights into the health and potential of different regions, helping you identify promising investment opportunities.

Understanding GDP Growth and its Impact: Regions exhibiting strong and sustainable GDP growth generally offer a more favorable investment climate. This indicates a healthy economy with potential for increased returns.

- Examples of regions with high GDP growth: While specific regions fluctuate, consistently strong performers often include certain areas of Asia and some developing nations in Africa and South America. However, this is dynamic and requires up-to-date research.

- Factors influencing GDP growth: Innovation, robust infrastructure, a skilled workforce, and government policies all contribute to strong GDP growth. Access to resources and natural assets are also major factors.

- Resources for accessing GDP data: The World Bank, International Monetary Fund (IMF), and national statistical agencies provide reliable data on GDP growth rates.

The Importance of Unemployment Rates: Low unemployment rates signal a robust labor market, essential for business success. A strong labor market means businesses can easily find and retain skilled employees.

- Correlation between low unemployment and business growth: Low unemployment often correlates with increased consumer spending and business expansion, creating a positive feedback loop for investment.

- Accessing unemployment data by region: National labor statistics agencies, such as the Bureau of Labor Statistics in the US, provide detailed unemployment data at regional and national levels.

- Industries with high demand for labor in specific regions: Tech hubs often have high demand for software engineers, while manufacturing regions may see demand for skilled tradespeople. Understanding these local demands is key.

Inflation and its Effect on Investment Strategies: Inflation erodes the purchasing power of money. Considering inflation rates is vital for assessing the real return on investment, rather than just the nominal return.

- Strategies for mitigating inflation risk: Diversification across asset classes (stocks, bonds, real estate) and inflation-protected securities can help mitigate inflation risk.

- Regions with stable inflation rates: Regions with central banks effectively managing inflation typically offer more predictable investment environments. This requires ongoing monitoring and analysis.

- The impact of inflation on different asset classes: Inflation can affect different asset classes differently; for example, real estate may offer a hedge against inflation, while bonds might suffer.

Evaluating Infrastructure and Business-Friendly Environments

Beyond economic indicators, the quality of infrastructure and the overall business environment play a crucial role in investment success.

The Role of Transportation and Logistics: Efficient transportation networks are paramount for businesses, impacting supply chain costs and overall competitiveness.

- Access to major transportation hubs (airports, ports, highways): Proximity to efficient transportation networks reduces logistics costs and improves market access.

- Impact of logistics costs on business profitability: High logistics costs can significantly impact a business's bottom line, reducing profitability.

- Government investment in infrastructure: Government investment in infrastructure development indicates a forward-looking approach and commitment to economic growth.

Assessing the Regulatory Landscape: Favorable regulations and government support create a business-friendly environment, encouraging investment and growth.

- Tax incentives: Tax incentives and breaks can significantly reduce business costs and boost profitability.

- Ease of doing business rankings: International organizations publish rankings that assess the ease of starting and operating a business in different countries.

- Government support programs for businesses: Government programs offering grants, loans, and other support can provide significant advantages to businesses.

- Regulatory hurdles to consider: Understanding and navigating potential regulatory hurdles is crucial for successful business operations.

Access to Skilled Labor and Talent: A skilled workforce is essential for innovation, productivity, and overall competitiveness.

- Regional educational institutions: The presence of strong educational institutions indicates a readily available pool of skilled labor.

- Availability of specialized skills: Access to specialized skills tailored to specific industry needs is crucial for many businesses.

- Training programs and initiatives: Government-supported and private sector training programs can help bridge skills gaps.

Identifying Emerging Markets and Growth Sectors

Identifying emerging markets and high-growth sectors can significantly enhance investment returns.

Technological Innovation and Investment Hotspots: Regions at the forefront of technological advancements offer significant potential for growth.

- Examples of tech hubs and emerging technologies: Silicon Valley, Boston, and Bangalore are examples of established tech hubs, while many new ones are constantly emerging.

- Government investment in R&D: Government investment in research and development fosters innovation and attracts investment.

- Access to venture capital: Abundant venture capital fuels the growth of technology startups and other innovative businesses.

Sustainable and Green Investments: The growing demand for sustainable and environmentally friendly products and services presents significant investment opportunities.

- Government policies supporting green initiatives: Government policies promoting renewable energy and sustainable practices drive innovation and investment.

- Growing demand for sustainable products and services: Consumer preference for environmentally conscious products is increasing, driving growth in this sector.

- Investment in renewable energy: Renewable energy represents a significant growth sector, with substantial investment opportunities.

Analyzing Demographic Trends and Consumer Behavior: Understanding demographic shifts and evolving consumer preferences is crucial for identifying lucrative markets.

- Population growth: Regions with strong population growth often offer expanding markets for goods and services.

- Age distribution: Understanding the age distribution helps businesses target their products and services to specific demographics.

- Consumer spending patterns: Analyzing consumer spending patterns reveals insights into consumer preferences and market demands.

- Market research resources: Market research firms and government agencies provide data and analysis on consumer behavior and market trends.

Conclusion:

Choosing where to invest now requires a multifaceted approach, considering economic indicators, infrastructure, the business environment, and emerging market trends. By analyzing key indicators like GDP growth, unemployment rates, and regulatory environments, alongside identifying burgeoning sectors like sustainable investments and technological innovation, investors can significantly increase their probability of success. This data-driven approach helps navigate the complexities and pinpoint the most promising business locations. Start your investment journey today by utilizing this information to find the best place to invest now and secure a profitable future. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

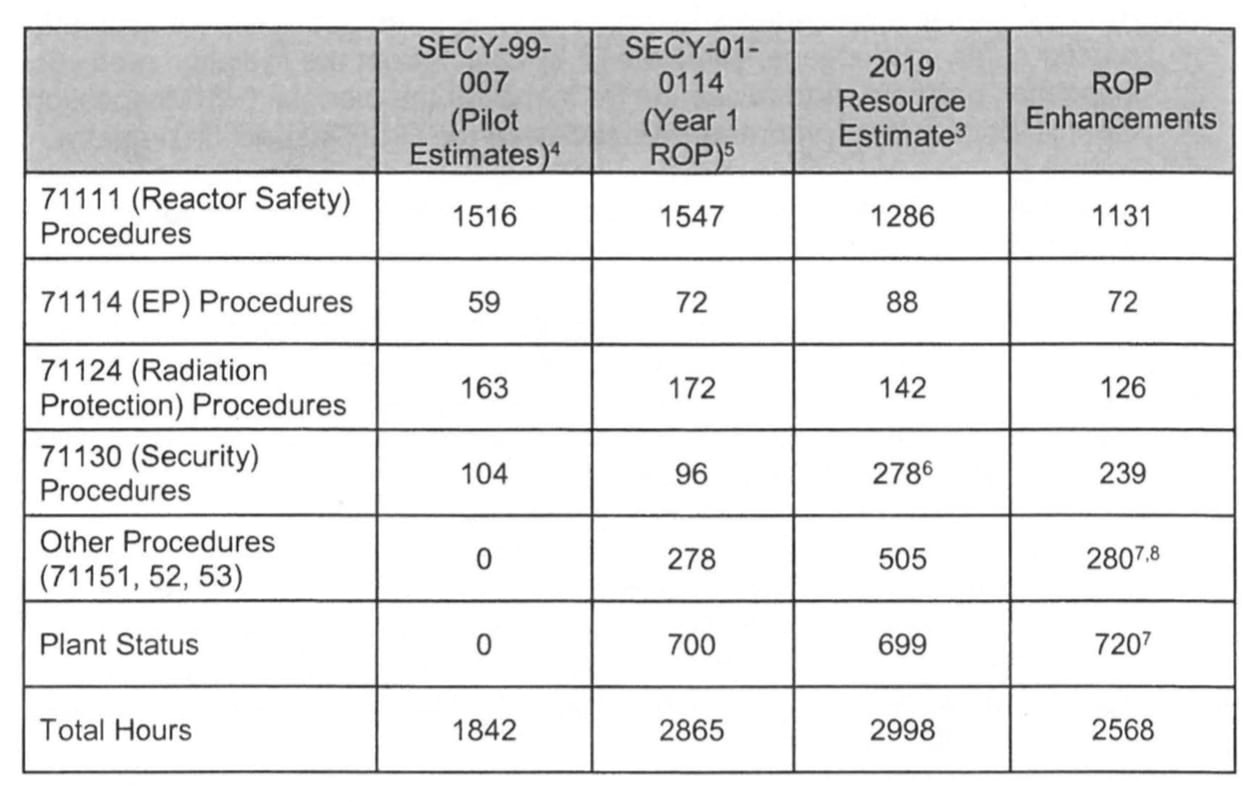

Understanding The Nrcs Review Process For Reactor Power Uprates

May 02, 2025

Understanding The Nrcs Review Process For Reactor Power Uprates

May 02, 2025 -

Glastonbury 2025 Secure Your Resale Tickets Now

May 02, 2025

Glastonbury 2025 Secure Your Resale Tickets Now

May 02, 2025 -

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentencing

May 02, 2025

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentencing

May 02, 2025 -

Grote Elektriciteitsstoring In Breda 30 000 Zonder Stroomvoorziening

May 02, 2025

Grote Elektriciteitsstoring In Breda 30 000 Zonder Stroomvoorziening

May 02, 2025 -

Los Angeles Wildfires Gambling On Tragedy And Its Implications

May 02, 2025

Los Angeles Wildfires Gambling On Tragedy And Its Implications

May 02, 2025

Latest Posts

-

4 5

May 10, 2025

4 5

May 10, 2025 -

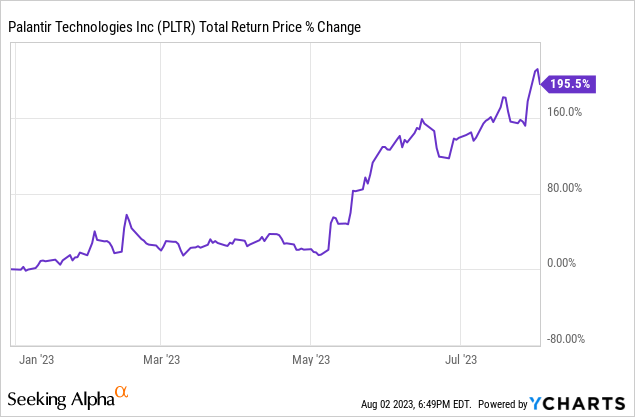

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025 -

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025 -

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025