Will The SEC Declare XRP A Commodity? Ripple Settlement Implications

Table of Contents

The Ripple-SEC Lawsuit and its Fallout

The long-running legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) centered on the SEC's claim that XRP is an unregistered security. The SEC argued that Ripple's sales of XRP constituted the offering of investment contracts, violating federal securities laws.

- Summary of the SEC's key claims: The SEC asserted that Ripple engaged in an unregistered securities offering, arguing that XRP investors anticipated profits based on Ripple's efforts.

- Ripple's defense and counterarguments: Ripple maintained that XRP is a decentralized digital asset functioning as a currency and not a security. They argued that most XRP sales were not subject to the Howey Test.

- Key events and rulings during the lawsuit: The case involved extensive discovery, expert witness testimony, and legal arguments focusing on the Howey Test and the nature of XRP's functionality.

- The significance of the partial settlement: The partial settlement between Ripple and the SEC concluded in late 2023. Importantly, the settlement specifically addressed programmatic sales, a key point of contention, largely leaving the classification of other XRP sales ambiguous. This partial resolution significantly impacts the ongoing debate, but it doesn't fully resolve the question of XRP's classification.

The settlement, while not offering a definitive answer on XRP's classification, significantly altered the landscape. The SEC's continued pursuit of clarity regarding other XRP sales and the lack of a broader ruling on XRP's inherent nature means the "Will the SEC Declare XRP a Commodity?" question remains largely open.

Arguments for XRP as a Commodity

Several arguments support classifying XRP as a commodity rather than a security.

- Decentralization of XRP and its network: Proponents argue that XRP's network operates independently of Ripple Labs, exhibiting significant decentralization. This contrasts sharply with securities typically linked to a central issuer.

- Functionality of XRP as a medium of exchange: XRP is primarily designed to facilitate fast, low-cost cross-border transactions, functioning much like other cryptocurrencies used as a medium of exchange.

- Comparison to other cryptocurrencies classified as commodities: Many other cryptocurrencies, such as Bitcoin and Ethereum, are widely considered commodities, setting a precedent for XRP's potential classification.

- Analysis of how XRP operates within the market: Market analysis reveals XRP's price is largely determined by supply and demand, akin to other commodities traded on exchanges. Its price fluctuates based on market forces, rather than being directly influenced by Ripple Labs' actions.

The arguments for XRP as a commodity emphasize its decentralized nature and its function as a medium of exchange, aligning it with other established crypto commodities.

Arguments Against XRP as a Commodity

Conversely, arguments exist against classifying XRP as a commodity.

- The role of Ripple Labs in XRP's initial distribution: Ripple Labs initially controlled a significant portion of XRP's supply, raising concerns about potential centralized control and influence over its price.

- Potential for future centralized control: While the network is decentralized, the possibility of Ripple exerting future control or influence cannot be entirely discounted.

- The Howey Test and its application to XRP: The Howey Test, a key legal standard for determining whether an asset is a security, examines whether an investment involves an expectation of profit derived from the efforts of others. The SEC's interpretation applies this test to XRP sales, arguing that investors reasonably expected profits based on Ripple's efforts.

- The SEC's interpretation of investment contracts: The SEC's stringent interpretation of investment contracts creates a higher barrier for cryptocurrencies to be considered commodities.

These arguments highlight concerns about Ripple's historical role and the SEC's interpretation of the Howey Test, suggesting a case for XRP as a security.

Potential Implications of XRP Classification

The classification of XRP as a security or a commodity has significant implications.

- Impact on XRP's price and market capitalization: A commodity classification could lead to increased market stability and potentially higher prices, while a security classification could restrict trading and negatively impact its value.

- Regulatory implications for exchanges listing XRP: Exchanges listing XRP would face different regulatory burdens depending on its classification.

- Legal ramifications for investors holding XRP: Investors might face different tax liabilities and legal risks depending on whether XRP is classified as a security or a commodity.

- Effects on the broader cryptocurrency market: The outcome will significantly influence the regulatory landscape for other cryptocurrencies, setting a precedent for future classifications.

The uncertainty surrounding XRP's classification creates considerable risk and uncertainty for investors and the broader crypto market.

Conclusion

The question, "Will the SEC Declare XRP a Commodity?" remains unanswered, highlighting the complexity of classifying cryptocurrencies under existing securities laws. The Ripple settlement provided partial clarity, but the broader issue persists. The arguments for and against XRP's commodity classification are compelling, reflecting the ongoing debate surrounding the regulatory framework for digital assets. The SEC's final decision will have far-reaching consequences for XRP's price, regulatory compliance for exchanges, investor rights, and the broader cryptocurrency market. Stay updated on the latest developments regarding the SEC's classification of XRP and the implications of the Ripple settlement. Understanding the potential classification of XRP as a commodity is crucial for navigating the evolving cryptocurrency landscape. Continue to research the Will the SEC Declare XRP a Commodity? question and its impact on your investments.

Featured Posts

-

Christina Aguilera New Photos Raise Questions About Excessive Photo Editing

May 02, 2025

Christina Aguilera New Photos Raise Questions About Excessive Photo Editing

May 02, 2025 -

De Bio Based Basisschool Noodzaak Van Een Noodgenerator

May 02, 2025

De Bio Based Basisschool Noodzaak Van Een Noodgenerator

May 02, 2025 -

Barrow Afc Fans Cycle For Sky Bet Every Minute Matters Relay

May 02, 2025

Barrow Afc Fans Cycle For Sky Bet Every Minute Matters Relay

May 02, 2025 -

The Us Steps Up Vaccine Surveillance Due To Measles Outbreak

May 02, 2025

The Us Steps Up Vaccine Surveillance Due To Measles Outbreak

May 02, 2025 -

Waarom Geeft Nrc Zijn Abonnees Nu Gratis Toegang Tot The New York Times

May 02, 2025

Waarom Geeft Nrc Zijn Abonnees Nu Gratis Toegang Tot The New York Times

May 02, 2025

Latest Posts

-

4 5

May 10, 2025

4 5

May 10, 2025 -

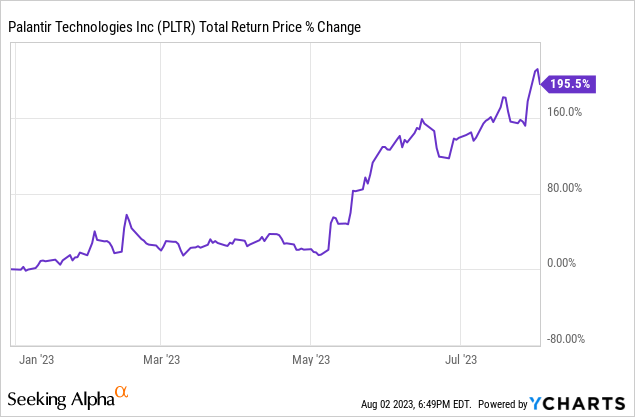

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025 -

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025 -

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025