XRP Price Prediction: Analyzing The Potential For A $10 Surge

Table of Contents

Technical Analysis: Chart Patterns and Indicators Suggesting Potential Growth

Technical analysis provides valuable insights into potential price movements by studying historical price data and identifying patterns. Analyzing XRP's historical charts reveals key support and resistance levels that could influence future price action.

-

Key Support and Resistance Levels: Identifying past price points where XRP experienced significant buying or selling pressure can help predict future price reversals. Support levels represent prices where buying pressure is expected to outweigh selling pressure, potentially preventing further declines. Resistance levels, conversely, mark areas where selling pressure may dominate, capping upward price movements.

-

Technical Indicators: Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) can offer signals about momentum, trend strength, and potential buy/sell opportunities. A bullish divergence (price making lower lows while the RSI makes higher lows, for example) could suggest a potential upward price reversal.

-

Breakout Scenarios: A decisive break above a significant resistance level could trigger a substantial price rally, potentially pushing XRP towards the $10 target. However, the extent and sustainability of such a rally depend on various factors, including overall market sentiment and trading volume.

-

Price Corrections and Consolidations: It's crucial to acknowledge the possibility of price corrections and consolidation phases following significant price movements. These periods of sideways trading are natural and often precede further upward or downward trends. Understanding these phases is vital for managing risk and avoiding impulsive trading decisions.

[Insert relevant charts and graphs visualizing technical analysis here]

Market Sentiment and Adoption: Factors Driving XRP's Price

Market sentiment plays a crucial role in driving cryptocurrency prices. Positive sentiment, fueled by adoption, partnerships, and news, often results in price appreciation.

-

Social Media Sentiment: Monitoring social media trends and online discussions about XRP can provide insights into prevailing market sentiment. Positive news and growing community engagement often correlate with price increases.

-

Institutional Adoption: The growing adoption of XRP by financial institutions and payment processors is a significant factor influencing its price. Increased institutional investment signifies greater market confidence and often leads to higher demand.

-

Partnerships and Collaborations: Strategic partnerships and collaborations with major players in the financial industry can significantly boost XRP's price. Such partnerships demonstrate the practicality and scalability of Ripple's technology.

-

Overall Market Conditions: Bitcoin's price and the overall cryptocurrency market sentiment significantly impact XRP's performance. A bullish Bitcoin market often leads to increased investor interest in altcoins like XRP.

Regulatory Landscape and Legal Battles: Potential Impacts on XRP Price

The ongoing SEC lawsuit against Ripple and its potential outcomes significantly affect XRP's price.

-

SEC Lawsuit Outcome: A favorable ruling could trigger a significant price surge, as it would likely remove a major source of uncertainty for investors. An unfavorable outcome, however, could lead to a temporary price decline, though the long-term impact remains uncertain.

-

Regulatory Clarity: Increased regulatory clarity concerning cryptocurrencies globally could positively impact investor confidence and lead to higher price appreciation for XRP. Conversely, unfavorable regulations could suppress price growth.

-

Exchange Listings: Delisting from major exchanges could negatively impact XRP's price due to reduced liquidity and accessibility. Conversely, new listings on prominent exchanges can contribute to price increases.

Technological Advancements and Ripple's Developments: Fueling Future Growth?

Ripple's continued technological advancements and the development of new products and services using XRP are key to its long-term potential.

-

XRP Ledger Improvements: Ongoing upgrades and improvements to the XRP Ledger, enhancing its speed, scalability, and security, can increase its attractiveness to businesses and investors.

-

New Products and Services: The development of new products and services built on the XRP Ledger, particularly in cross-border payments, can drive wider adoption and increase demand for XRP.

-

Blockchain Technology Advancement: The evolution of blockchain technology and its potential to revolutionize financial transactions strengthens the long-term prospects of XRP.

Conclusion: XRP Price Prediction - A Complex Equation

Predicting the future price of XRP, or any cryptocurrency, is speculative. However, by analyzing technical indicators, market sentiment, the regulatory landscape, and technological advancements, we can gain a more informed perspective on the potential for a $10 XRP price prediction. Reaching $10 remains ambitious and hinges on several favorable factors. However, continued development of the XRP Ledger, increased adoption, and a positive resolution to the SEC lawsuit could significantly fuel XRP's price appreciation.

Call to Action: Stay updated on XRP news and developments to make informed investment decisions. Remember to conduct thorough research and assess your risk tolerance before investing in any cryptocurrency, including XRP. Understanding the intricacies of XRP price prediction is key to navigating this exciting but volatile market.

Featured Posts

-

Slah Fy Khtr Jw 24 Ynshr Thdhyra Bshan Mghamrath

May 02, 2025

Slah Fy Khtr Jw 24 Ynshr Thdhyra Bshan Mghamrath

May 02, 2025 -

Trumps Tariffs Face Legal Challenge Judicial Review At Stake

May 02, 2025

Trumps Tariffs Face Legal Challenge Judicial Review At Stake

May 02, 2025 -

Another 80s Tv Icon Passes Remembering Their Time On Dallas

May 02, 2025

Another 80s Tv Icon Passes Remembering Their Time On Dallas

May 02, 2025 -

Fortnite Community Outraged By Recent Item Shop Changes

May 02, 2025

Fortnite Community Outraged By Recent Item Shop Changes

May 02, 2025 -

National Award Honors Nebraskas Voter Id Campaign Excellence

May 02, 2025

National Award Honors Nebraskas Voter Id Campaign Excellence

May 02, 2025

Latest Posts

-

4 5

May 10, 2025

4 5

May 10, 2025 -

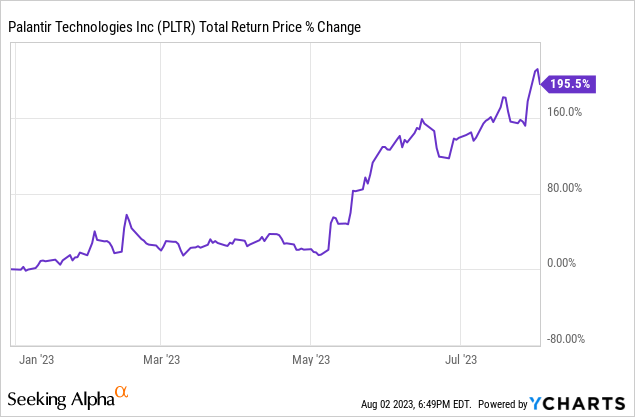

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025 -

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025 -

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025