Elon Musk Net Worth Dips: Tesla Stock Decline And Tariff Challenges

Table of Contents

Tesla Stock Performance and its Impact on Musk's Net Worth

Tesla's stock performance directly influences a large portion of Elon Musk's net worth. Recent market fluctuations have significantly impacted Tesla's share price, leading to a considerable decrease in Musk's overall wealth. The stock market's reaction to various news events, such as production delays, increased competition from established automakers and new entrants, and broader economic concerns, all contribute to the volatility.

- Quantifying the Impact: A 10% drop in Tesla's stock price, for instance, translates to a substantial loss in Musk's net worth, given his significant ownership stake. The exact figure fluctuates constantly depending on the share price and the number of shares he owns. This highlights the inherent risk associated with concentrating a large portion of one's wealth in a single company's stock.

- Analyst Predictions and Investor Sentiment: Analyst predictions regarding future Tesla stock performance vary widely. Some remain bullish, citing Tesla's innovative technology and potential for future growth, while others express caution, pointing to challenges in scaling production, increasing competition, and economic uncertainties. Investor sentiment plays a crucial role; any negative news or perceived setbacks can lead to a sell-off, further impacting the share price and Musk's net worth.

- Market Capitalization and Share Value: It is important to understand that Musk's net worth is intricately linked to Tesla's market capitalization. As the market cap rises and falls, so does the value of his shares, directly affecting his overall wealth. This makes his financial situation highly susceptible to market forces.

The Role of Tariffs in Affecting Tesla's Global Market and Musk's Wealth

International tariffs pose a significant challenge to Tesla's global ambitions and, consequently, to Elon Musk's wealth. These import taxes increase the cost of manufacturing and shipping Tesla vehicles in various international markets. The impact is twofold: increased production costs and higher consumer prices.

- Specific Tariff Impacts: Tariffs imposed by different countries on imported electric vehicles or components directly affect Tesla's profitability in those regions. For example, tariffs in certain markets could make Tesla cars less competitive compared to locally produced vehicles or those from countries with more favorable trade agreements.

- Effect on Sales and Market Share: Higher prices due to tariffs can reduce Tesla's competitiveness, potentially leading to lower sales and a reduced market share in affected regions. This translates to lower revenue for Tesla and, consequently, a negative impact on Musk's wealth.

- Navigating Trade Barriers: The complexities of navigating international trade regulations and tariffs add to Tesla’s operational costs, diverting resources from other areas like research and development or expansion plans. This further complicates Tesla’s financial performance and, consequently, Elon Musk's net worth.

Diversification of Musk's Investments and their Cushioning Effect

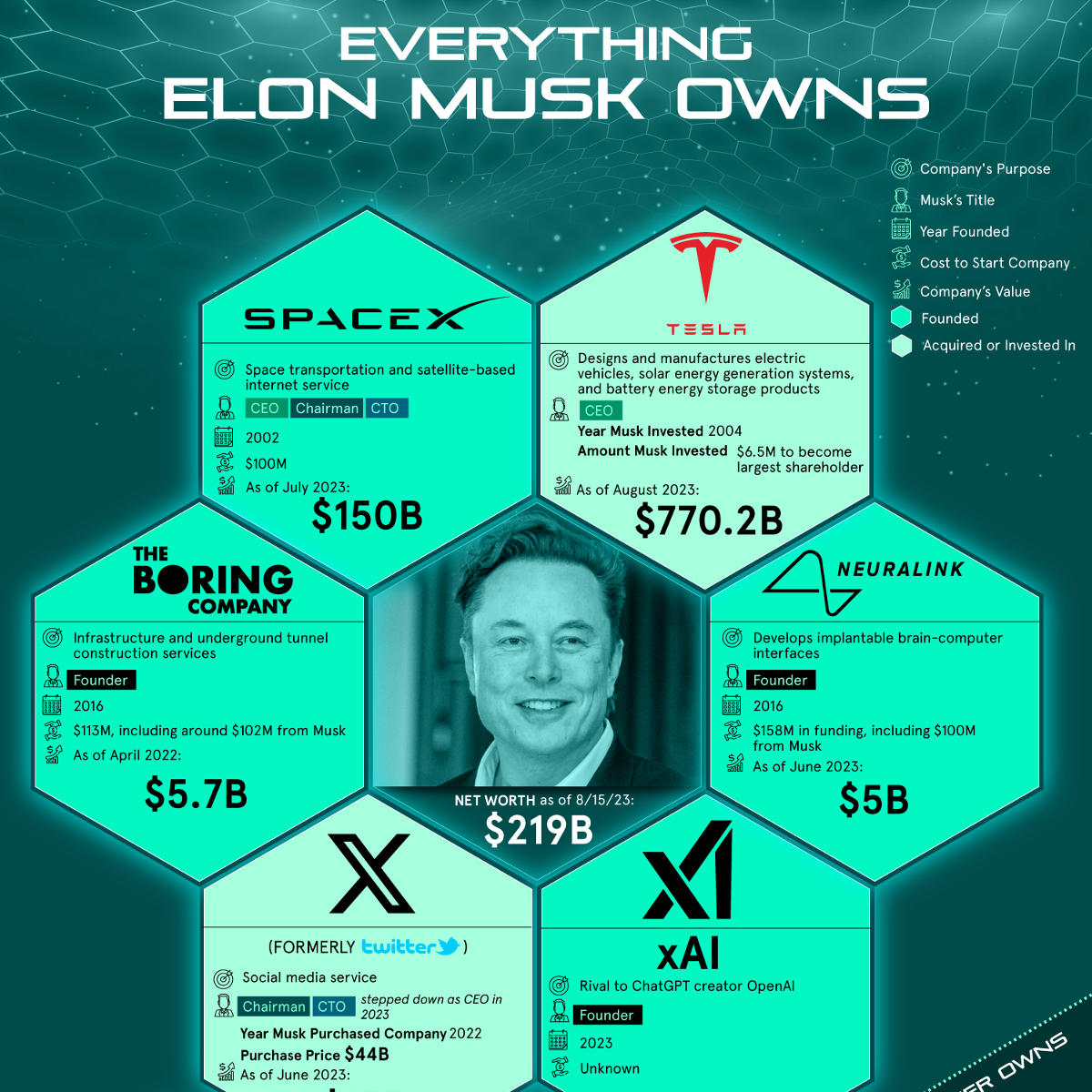

While Tesla remains a significant driver of Elon Musk's wealth, his investment portfolio is not limited to the electric vehicle maker. SpaceX, his aerospace company, represents another substantial asset. The performance of SpaceX, while less publicly scrutinized than Tesla, can offset some of the impact from Tesla's market fluctuations.

- Relative Value of Diversified Holdings: While precise figures are not always publicly available, it’s acknowledged that SpaceX holds considerable value, acting as a buffer against fluctuations in Tesla's stock price. This portfolio diversification is a key strategy in risk management.

- SpaceX Performance and Potential: SpaceX's successes in space exploration and commercial launches contribute positively to Musk's overall net worth, providing a degree of stability despite Tesla's challenges. Future successes in this field could further enhance his wealth.

- Importance of Portfolio Diversification: The concept of diversification is crucial in mitigating risk. By spreading investments across different sectors and asset classes, individuals and companies can reduce the overall impact of negative performance in any single asset. This is a fundamental principle in mitigating substantial wealth fluctuations.

Conclusion

The recent dip in Elon Musk's net worth is largely attributable to the decline in Tesla's stock price and the challenges posed by international tariffs. While Tesla’s performance heavily influences his wealth, the diversification of his investments, particularly the success of SpaceX, offers a degree of cushioning against extreme fluctuations. However, understanding the interconnectedness of these factors is key to comprehending the ever-shifting landscape of Elon Musk's net worth.

Call to Action: Stay informed about the evolving factors influencing Elon Musk's net worth. Follow news and analysis regarding Tesla's stock performance, the global economic climate, and international trade policies to gain a comprehensive understanding of the intricacies impacting his wealth and the wider economic implications. Understanding these factors is crucial for navigating the fluctuating world of Elon Musk's net worth and similar high-profile investments.

Featured Posts

-

Credit Suisse Whistleblower Reward Up To 150 Million

May 09, 2025

Credit Suisse Whistleblower Reward Up To 150 Million

May 09, 2025 -

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Essential Workers

May 09, 2025

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Essential Workers

May 09, 2025 -

Elizabeth City Police Seek Suspect In Vehicle Break Ins

May 09, 2025

Elizabeth City Police Seek Suspect In Vehicle Break Ins

May 09, 2025 -

Understanding The Candidates In Your Nl Federal Riding

May 09, 2025

Understanding The Candidates In Your Nl Federal Riding

May 09, 2025 -

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025

Latest Posts

-

4 5

May 10, 2025

4 5

May 10, 2025 -

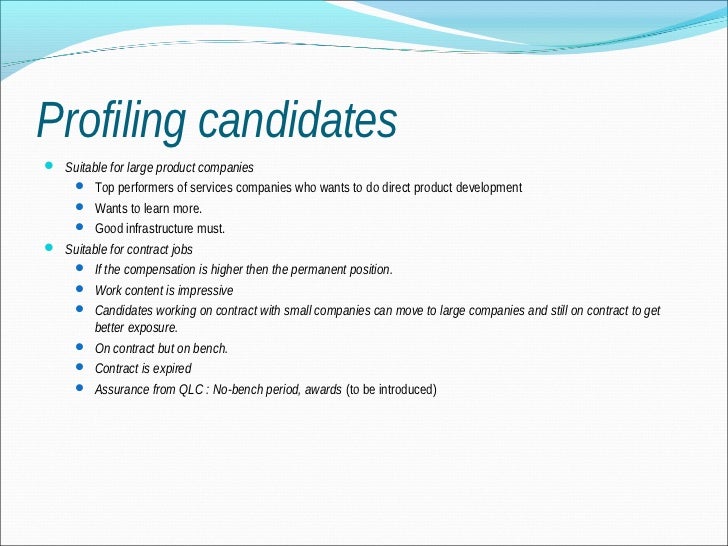

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025 -

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025 -

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025