How To Interpret The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Calculating the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF

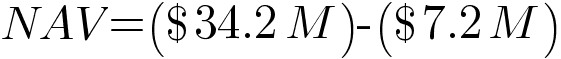

The NAV of the Amundi DJIA UCITS ETF, like all ETFs, is calculated using a straightforward formula:

(Total Assets - Total Liabilities) / Number of Outstanding Shares

Let's break down each component:

-

Total Assets: This represents the total market value of all the assets held within the ETF. For the Amundi DJIA UCITS ETF, this primarily includes:

- Holdings in the 30 companies comprising the Dow Jones Industrial Average (DJIA). The value of these holdings fluctuates daily based on the market price of each company's stock.

- Cash and cash equivalents: The ETF holds some cash for operational purposes.

- Receivables: Any money owed to the ETF.

-

Total Liabilities: These are the obligations and expenses associated with managing the ETF:

- Expense Ratio: This is the annual fee charged for managing the ETF.

- Accrued Fees: Any unpaid fees or expenses.

- Other Liabilities: Any other outstanding debts or obligations.

-

Number of Outstanding Shares: This is the total number of Amundi DJIA UCITS ETF shares currently in circulation.

Impact of Currency Fluctuations: Since the DJIA includes companies operating globally, the ETF might hold assets denominated in various currencies. Fluctuations in exchange rates can directly impact the calculation of the NAV, as asset values are converted into the ETF's base currency (typically Euros). The NAV is usually calculated daily, reflecting these changes.

Factors Affecting the Amundi DJIA UCITS ETF NAV

Several factors influence the NAV of the Amundi DJIA UCITS ETF:

-

Performance of the Dow Jones Industrial Average (DJIA): The primary driver of the ETF's NAV is the overall performance of the DJIA. A rising DJIA generally leads to a higher NAV, while a falling DJIA results in a lower NAV. This is because the ETF aims to track the DJIA's performance.

-

Dividends from Underlying Companies: When the companies within the DJIA pay dividends, the ETF receives these payments, which increase its total assets and consequently, its NAV.

-

Expense Ratio: The ETF's expense ratio, while small, represents a continuous deduction from the total assets, slightly reducing the NAV over time.

-

Market Sentiment and Investor Demand: While the NAV represents the intrinsic value, market sentiment and investor demand can cause the ETF's market price to deviate slightly (trade at a premium or discount) from the NAV in the short term.

-

Unexpected Events: Major economic downturns, corporate scandals involving DJIA companies, or geopolitical events can significantly impact the NAV, often causing sharp fluctuations.

Interpreting the Amundi DJIA UCITS ETF NAV for Investment Decisions

Understanding the NAV is essential for strategic investment decisions:

-

NAV vs. Market Price: Comparing the NAV to the ETF's market price helps identify potential buying or selling opportunities. If the market price is significantly below the NAV (a discount), it might present a buying opportunity. Conversely, a premium (market price above NAV) might suggest a potential selling opportunity.

-

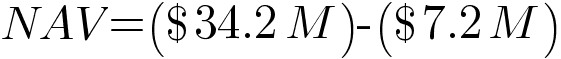

NAV Trends: Monitoring the NAV's trend over time provides insights into the long-term performance of the ETF. A consistently rising NAV indicates positive performance.

-

Holistic Approach: Use NAV information alongside other key metrics, such as the expense ratio, historical performance data, and your personal risk tolerance, to make informed decisions.

-

Reliable Sources: Always rely on official sources for accurate NAV information, such as the Amundi website or reputable financial data providers.

-

Bid and Ask Price: Remember that the price you buy or sell the ETF at (bid and ask price) might differ slightly from the NAV due to market dynamics.

Accessing Amundi DJIA UCITS ETF NAV Data

Accessing real-time and historical NAV data is straightforward:

-

Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

-

Financial Data Providers: Reputable financial websites and data providers (e.g., Bloomberg, Refinitiv) also provide access to NAV data.

-

Data Interpretation: Pay attention to the time zone and reporting standards used when interpreting the data.

-

Tracking NAV: Utilize spreadsheets, financial software, or dedicated investment platforms to track the NAV over time.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Interpretation

Understanding and interpreting the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is fundamental for effective investment management. By carefully considering the factors influencing the NAV, comparing it to the market price, and monitoring its trends over time, you can make informed decisions. Remember to utilize reliable data sources and combine NAV analysis with other relevant metrics for a holistic investment strategy. Start monitoring the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF today to optimize your investment strategy! [Link to Amundi ETF Fact Sheet]

Featured Posts

-

Les Architectes Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 24, 2025

Les Architectes Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 24, 2025 -

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025 -

Strengthening Ties Bangladeshs Renewed Focus On European Collaboration

May 24, 2025

Strengthening Ties Bangladeshs Renewed Focus On European Collaboration

May 24, 2025 -

Euronext Amsterdam Stock Market 8 Rise Following Us Tariff Pause

May 24, 2025

Euronext Amsterdam Stock Market 8 Rise Following Us Tariff Pause

May 24, 2025 -

Latest On Kyle Walker Peters Potential Transfer To Leeds

May 24, 2025

Latest On Kyle Walker Peters Potential Transfer To Leeds

May 24, 2025

Latest Posts

-

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025 -

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025