XRP Investment Analysis: Post-SEC Ruling Price Projections

Table of Contents

The Ripple-SEC Lawsuit: A Summary and its Impact on XRP Price

The lengthy Ripple-SEC lawsuit centered on whether XRP is a security. The court's decision partially favored Ripple, ruling that programmatic sales of XRP were not securities, while other sales were deemed to be. This mixed outcome created significant uncertainty.

-

Impact on XRP trading volume and liquidity: Immediately following the ruling, XRP trading volume surged as investors reacted to the news. However, liquidity remains a factor to watch, as some exchanges initially delisted XRP due to legal concerns. The long-term impact on liquidity depends on further regulatory clarity and exchange decisions.

-

Short-term price volatility following the ruling: The price of XRP experienced significant short-term volatility post-ruling, reflecting the market’s uncertainty. Initial price jumps were followed by periods of consolidation, indicating a market still trying to find its footing.

-

Legal uncertainty and its effect on investor confidence: The partial nature of the win created ongoing legal uncertainty. This ambiguity affects investor confidence, influencing the willingness of both institutional and retail investors to hold or invest in XRP. Further legal challenges are possible, impacting future XRP price predictions.

-

Analysis of how different exchanges reacted: The response varied widely across exchanges. Some promptly reinstated XRP trading, while others maintained delistings, reflecting different risk assessments and regulatory interpretations. This fragmented response further contributed to the volatility in XRP price.

Analyzing Market Sentiment Towards XRP Post-Ruling

Market sentiment toward XRP remains mixed. While some view the partial SEC victory as positive, others remain cautious due to lingering legal and regulatory risks.

-

Social media sentiment analysis (positive/negative): Social media sentiment offers a mixed bag. While some communities celebrate the ruling as a win for decentralization, others remain concerned about the implications for future regulatory actions concerning XRP and other cryptocurrencies.

-

Changes in institutional investor interest: Institutional investors remain cautious, awaiting further regulatory clarity. The long-term participation of institutional money will significantly influence the XRP price prediction.

-

Impact on retail investor confidence: Retail investor sentiment is equally divided. Some see opportunities in the discounted XRP price, while others are hesitant due to the ongoing uncertainty.

-

Comparison to other cryptocurrencies affected by regulatory scrutiny: Comparing XRP's situation to other cryptocurrencies facing regulatory scrutiny provides valuable context. The SEC's actions influence the entire crypto market, affecting investor confidence and influencing the XRP price projection.

Factors Influencing Future XRP Price Projections

Numerous factors will influence XRP's future price. Predicting the future price of XRP is challenging, requiring careful consideration of all the influencing elements.

-

Technological advancements within the Ripple ecosystem (e.g., CBDC solutions): Ripple's ongoing development of CBDC solutions and other technological advancements could significantly drive adoption and, therefore, the XRP price.

-

Adoption by financial institutions and payment processors: Increased adoption by banks and payment processors is crucial for XRP's long-term success and price appreciation. This is a key factor in any XRP price prediction model.

-

Regulatory clarity in different jurisdictions: Regulatory clarity in various jurisdictions is paramount. A favorable regulatory landscape in key markets will be vital for XRP price stability and growth.

-

Overall cryptocurrency market trends and Bitcoin's performance: The broader cryptocurrency market and Bitcoin's performance will influence XRP. Positive overall market sentiment tends to be beneficial to altcoins like XRP.

-

Competition from other cryptocurrencies in the payment sector: XRP faces competition from other cryptocurrencies vying for a place in the payments sector. The competitive landscape will impact its market share and price.

XRP Price Projections: Short-Term and Long-Term Outlook

Providing precise XRP price projections is inherently speculative. However, considering the factors discussed, we can offer a cautious outlook.

-

Short-term price targets (months): In the short term (6-12 months), the price could fluctuate significantly based on regulatory developments and market sentiment. A range between $0.50 and $1.00 is possible, but highly dependent on external factors.

-

Long-term price targets (years), based on various scenarios: Over the long term (3-5 years), a more positive regulatory landscape and increased adoption could drive the price significantly higher. However, significant headwinds remain. Reaching $5 or higher requires substantial adoption and regulatory clarity.

-

Risk assessment and potential downsides: Investment in XRP carries significant risk. Regulatory uncertainty, competition, and broader market downturns could negatively impact the price.

-

Emphasis on responsible investment strategies: Investors should only allocate capital they can afford to lose and diversify their portfolios.

Technical Analysis of XRP Price Charts

Technical analysis of XRP price charts, including indicators like moving averages and relative strength index (RSI), can provide short-term insights. However, technical analysis should be used cautiously, in conjunction with fundamental analysis, when assessing the XRP price prediction.

Conclusion

The future price of XRP remains uncertain, depending heavily on several interconnected factors. The Ripple-SEC lawsuit outcome, market sentiment, regulatory clarity, technological advancements, and competition all play a role. While some scenarios suggest potential for significant price appreciation, it’s crucial to acknowledge the inherent risks involved in cryptocurrency investments. The provided XRP price projections are speculative and should be considered alongside your own due diligence.

Call to Action: While this XRP investment analysis offers insights into potential price movements, remember to conduct your own thorough research before making any investment decisions. Stay informed about the latest developments concerning XRP and the regulatory landscape to make well-informed decisions regarding your XRP investment strategy. Learn more about the potential of XRP and its future price projections by exploring further resources and consulting with financial advisors. Remember that any XRP price prediction is just that – a prediction, not a guarantee.

Featured Posts

-

Rio Tintos Dual Listing Survives Activist Campaign

May 02, 2025

Rio Tintos Dual Listing Survives Activist Campaign

May 02, 2025 -

Is Fortnite Offline Galactic Battle Launch And Server Issues

May 02, 2025

Is Fortnite Offline Galactic Battle Launch And Server Issues

May 02, 2025 -

Melissa Gorga Reveals Exclusive Beach House Guest Wish List

May 02, 2025

Melissa Gorga Reveals Exclusive Beach House Guest Wish List

May 02, 2025 -

Ahead Computings 21 5 Million Seed Funding Round

May 02, 2025

Ahead Computings 21 5 Million Seed Funding Round

May 02, 2025 -

Cassidy Hutchinson Memoir A Fall 2024 Release

May 02, 2025

Cassidy Hutchinson Memoir A Fall 2024 Release

May 02, 2025

Latest Posts

-

4 5

May 10, 2025

4 5

May 10, 2025 -

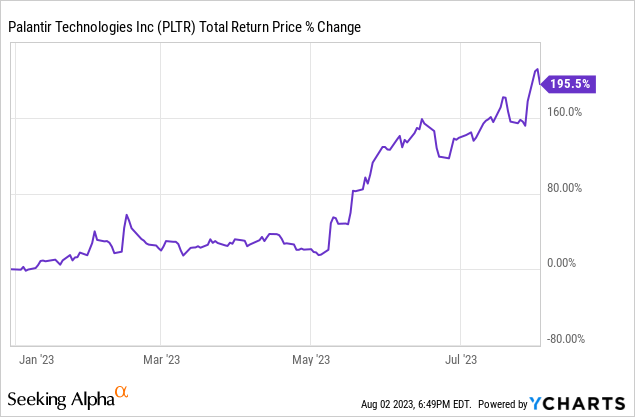

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025

Analyzing Palantirs Potential A 40 Stock Increase By 2025 Is It Achievable

May 10, 2025 -

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025

Late To The Game Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025 -

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025

Should You Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 10, 2025