Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. It's essentially the net worth of the fund per share. The NAV is calculated daily, typically at the close of the market, reflecting the value of the assets held within the ETF at that specific point in time. Understanding your ETF NAV, particularly the Amundi MSCI World II UCITS ETF Dist NAV, is key to gauging its performance and making sound investment choices. Regularly checking your ETF NAV helps you stay on top of your fund performance.

Introducing the Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist is an exchange-traded fund that tracks the MSCI World Index, providing exposure to a broad range of global equities. Its investment strategy focuses on diversification across various sectors and geographic regions. Tracking the Amundi MSCI World II UCITS ETF Dist NAV allows investors to monitor the performance of this diversified portfolio and assess its growth or decline relative to its benchmark index. Understanding the Amundi MSCI World II UCITS ETF Dist NAV fluctuations enables informed decisions regarding buy, hold, or sell strategies.

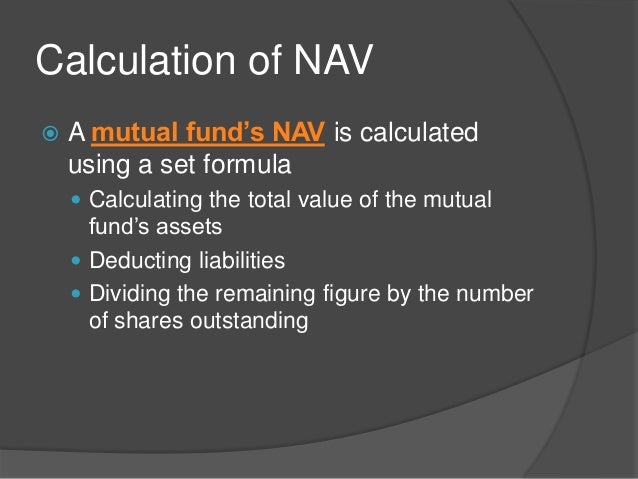

How the NAV of Amundi MSCI World II UCITS ETF Dist is Calculated

The NAV of the Amundi MSCI World II UCITS ETF Dist is calculated daily using a standardized process. This involves several key steps:

- Daily Closing Prices of Underlying Assets: The market value of each stock and other assets held in the ETF's portfolio is determined using the closing prices from the relevant exchanges.

- Currency Conversions: If the ETF holds assets denominated in currencies other than the base currency of the ETF, appropriate currency conversions are applied using prevailing exchange rates.

- Deduction of Management Fees and Expenses: The ETF's operating expenses, including management fees, are deducted from the total asset value.

- Calculation of NAV per Share: The net asset value (after expenses) is then divided by the total number of outstanding shares to arrive at the NAV per share.

Where to Find the Daily NAV of Amundi MSCI World II UCITS ETF Dist

Reliable sources for obtaining the daily Amundi MSCI World II UCITS ETF Dist NAV include:

- Amundi's Official Website: Amundi, the fund manager, typically publishes the daily NAV on their official website within their ETF listings. Look for sections dedicated to fund factsheets or performance data.

- Financial News Websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance usually provide ETF NAV data. Search for the ETF ticker symbol to find its current NAV.

- Brokerage Platforms: Most brokerage platforms that offer the Amundi MSCI World II UCITS ETF Dist will display the current NAV within the ETF's details page on their platform. This is often conveniently accessible within your portfolio view.

Always ensure you use reliable sources to avoid inaccuracies when tracking your Amundi MSCI World II UCITS ETF NAV.

Using NAV to Track Performance of Amundi MSCI World II UCITS ETF Dist

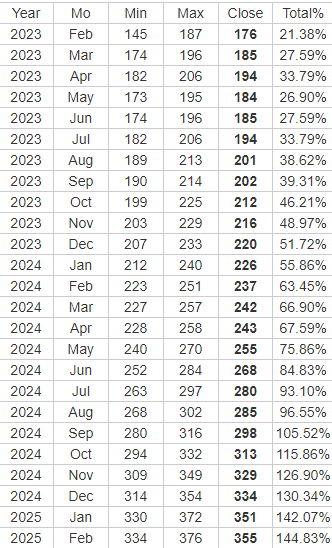

Using the daily NAV data, you can effectively monitor the Amundi MSCI World II UCITS ETF Dist's performance:

- Calculating Percentage Change in NAV: Compare the current NAV with previous NAVs to calculate the percentage change, giving you a clear picture of the fund's growth or decline.

- Analyzing Performance Against Benchmarks: Compare the ETF's NAV performance against its benchmark index (MSCI World Index) to assess how well it's tracking its target.

- Considering Factors Influencing NAV Fluctuations: Be aware that various factors, including market trends, economic news, and geopolitical events, can cause NAV fluctuations.

Tracking the Amundi MSCI World II UCITS ETF Dist NAV over time allows for a comprehensive understanding of its long-term performance.

Understanding the Relationship Between NAV and Unit Price of Amundi MSCI World II UCITS ETF Dist

While the NAV reflects the intrinsic value of the ETF, the unit price (market price) is the price at which the ETF is traded on the exchange. These two figures might differ due to market forces:

- Premium and Discount to NAV: The unit price can trade at a premium or discount to the NAV, influenced by supply and demand.

- How Market Trading Impacts the Unit Price: Market trading volume and investor sentiment can cause short-term fluctuations in the unit price, creating discrepancies from the NAV.

- Significance of Arbitrage Opportunities: Significant differences between the NAV and unit price can present arbitrage opportunities for sophisticated investors.

Understanding this difference is crucial for interpreting the Amundi MSCI World II UCITS ETF Dist's market behavior.

Interpreting NAV Fluctuations

Changes in the Amundi MSCI World II UCITS ETF Dist NAV are influenced by several factors:

- Market Volatility: Overall market fluctuations directly impact the value of the underlying assets within the ETF. A rising market generally leads to NAV increases, while a falling market can cause decreases.

- Economic Events: Significant economic news, such as interest rate changes or inflation reports, can influence investor sentiment and consequently affect the NAV.

- Performance of Underlying Holdings: The individual performance of the companies held within the ETF significantly impacts the overall NAV. Strong performance by constituent companies will tend to increase the NAV.

Analyzing these factors provides valuable context when interpreting NAV changes and making investment decisions.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV Tracking

Tracking the Amundi MSCI World II UCITS ETF Dist NAV is essential for informed investment decisions. By understanding how the NAV is calculated, where to find reliable data, and how to interpret its fluctuations, you can effectively monitor your investment's performance and make strategic adjustments as needed. Regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV, using the methods outlined above, empowers you to stay informed and make well-considered investment choices. Stay informed about your Amundi MSCI World II UCITS ETF Dist investments by regularly tracking its NAV.

Featured Posts

-

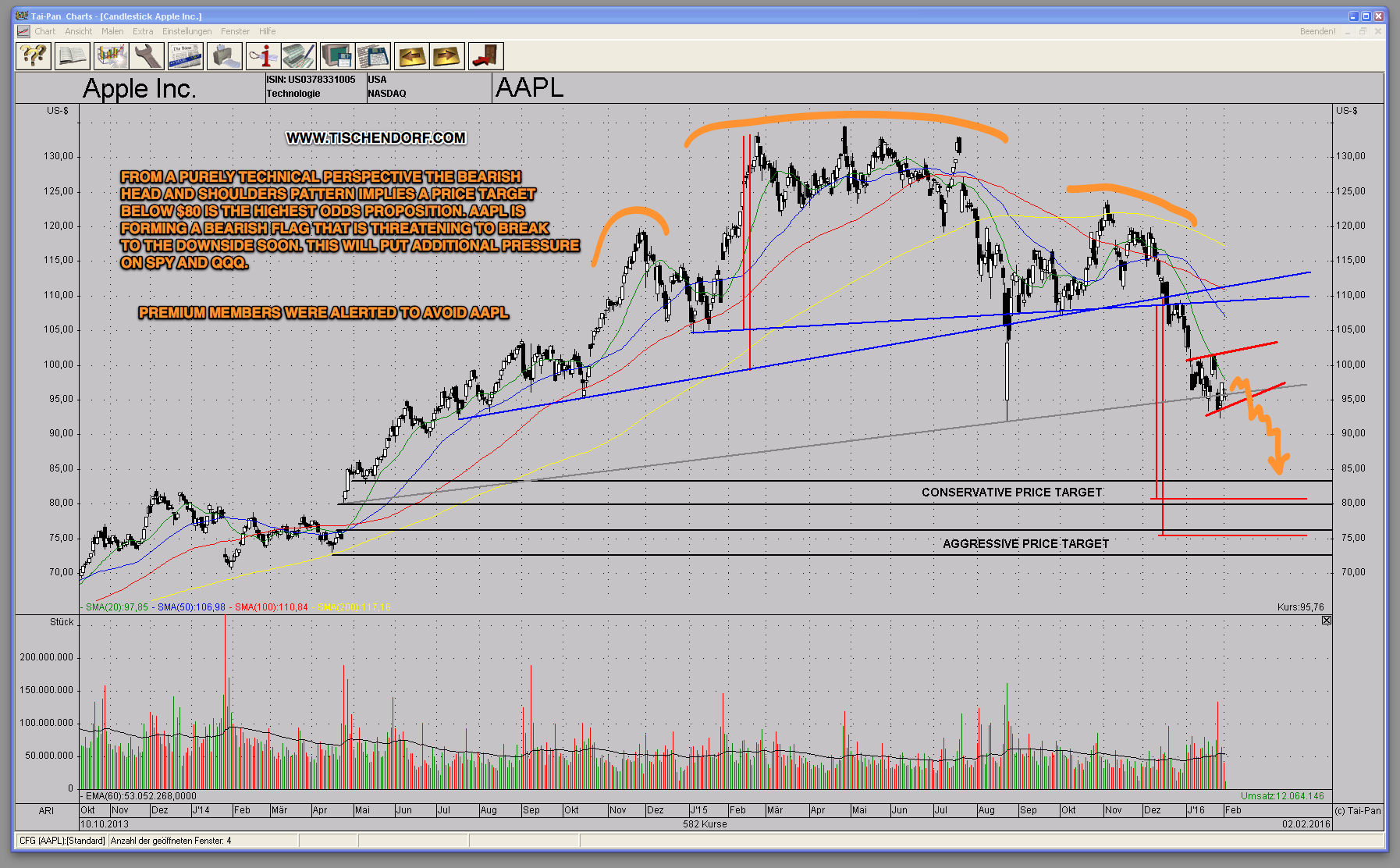

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025 -

Debate Reignites Macrons Party Wants To Ban Hijabs For Girls Under 15

May 24, 2025

Debate Reignites Macrons Party Wants To Ban Hijabs For Girls Under 15

May 24, 2025 -

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Impact Of Trumps Tariff Decision 8 Stock Increase On Euronext Amsterdam

May 24, 2025

Impact Of Trumps Tariff Decision 8 Stock Increase On Euronext Amsterdam

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

Latest Posts

-

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025 -

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025